Equipment and machinery appraisals are essential for financing, insurance claims, tax compliance, and business transactions, but the fees can quickly add up to thousands of dollars. Many business owners assume these costs are non-negotiable, yet experienced buyers routinely save 20-30% on appraisal fees through strategic preparation and smart negotiation tactics.

The key is understanding what drives appraisal costs and where you have leverage to negotiate without sacrificing the quality and defensibility your business needs. Whether you're preparing for SBA financing, updating insurance coverage, or handling estate planning, the right approach can help you secure professional, USPAP-compliant appraisals at fair market rates.

Quick Answer: Equipment appraisal fees typically range from $300-800 per hour or $150-500 per asset, depending on complexity, location, and report requirements. The biggest cost drivers are on-site inspection time, report depth, and specialized expertise requirements.

This guide walks you through proven strategies to reduce your appraisal costs while ensuring you get the professional, defensible valuation your situation requires.

Before you can negotiate effectively, you need to understand the main factors that determine appraisal fees. This knowledge gives you specific areas where you can create cost savings without compromising quality.

The type and complexity of your equipment significantly impacts pricing. Standard office equipment or common industrial machinery costs less to appraise than specialized manufacturing equipment or custom-built systems. Appraisers can work more efficiently with familiar equipment types, which translates to lower hourly costs for you.

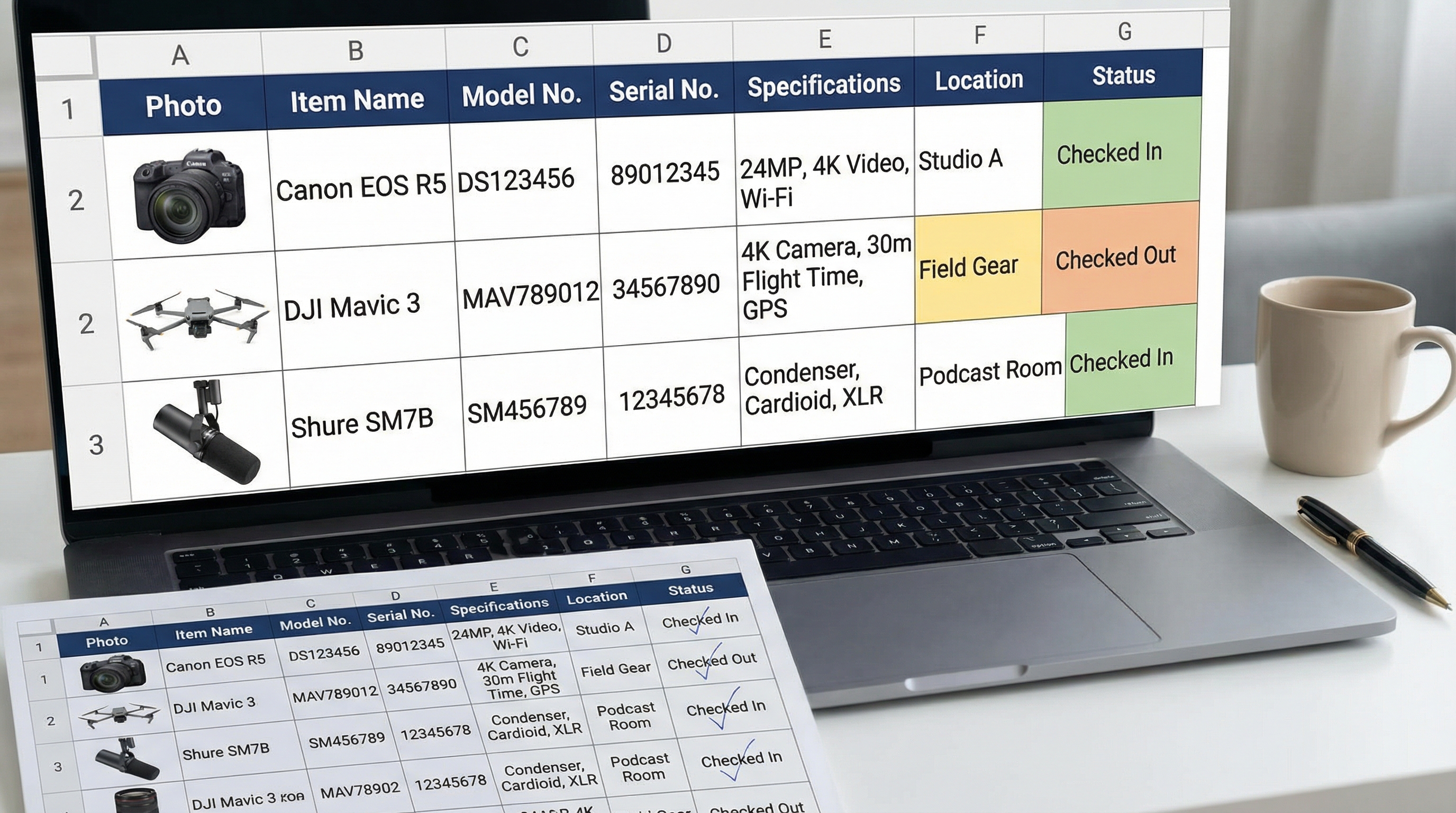

Your asset list preparation makes a huge difference in final costs. When you provide detailed information upfront including make, model, serial numbers, age, condition, and location, you reduce the time appraisers spend on discovery work. This preparation can cut 2-4 hours from most projects.

The scope of work you require directly affects your bill. Desktop appraisals using photos and documentation cost significantly less than full on-site inspections. Similarly, summary reports for internal planning cost less than comprehensive USPAP reports required for litigation or IRS compliance.

Geographic factors and travel requirements add substantial costs to many appraisals. If your equipment is located in remote areas or requires multiple site visits, expect higher fees. However, you can often negotiate these costs by consolidating inspections or providing detailed photos for preliminary assessments.

Equipment appraisers typically use one of four pricing structures, each offering different negotiation opportunities. Understanding these models helps you choose the most cost-effective approach for your situation.

Hourly billing remains the most common model, with rates typically ranging from $300-800 per hour depending on the appraiser's credentials and your location. The advantage is transparency, but costs can escalate if the project takes longer than expected. You can negotiate by providing excellent preparation materials and requesting time estimates upfront.

Per-asset pricing works well for large inventories of similar equipment. Appraisers often offer volume discounts when appraising multiple similar items, since they can work more efficiently. This model gives you predictable costs and creates natural negotiation leverage when you have substantial quantities.

Pricing ModelBest ForNegotiation LeverageTypical RangeHourlyComplex, unique equipmentPreparation quality, scope definition$300-800/hourPer-assetLarge inventories, similar itemsVolume discounts, bundling$150-500/assetFlat project feeWell-defined scope, standard equipmentScope adjustments, timeline flexibility$2,000-15,000RetainerOngoing needs, litigation supportLong-term agreements, guaranteed volume$5,000-25,000

Flat project fees provide cost certainty but require well-defined scope upfront. These work best when you have a clear inventory and standard reporting requirements. You can negotiate by adjusting the scope, timeline, or level of detail required in the final report.

Retainer arrangements make sense if you need ongoing appraisal services or litigation support. While the upfront cost is higher, the effective hourly rate is often lower, and you get priority scheduling and consistent service quality.

Your preparation before requesting quotes significantly impacts your negotiating position and final costs. Well-prepared clients consistently receive better pricing because they reduce the appraiser's risk and workload.

Start by clearly defining your appraisal purpose and required standards. Different uses require different levels of rigor and documentation. An internal planning appraisal needs less documentation than an IRS-compliant report for tax purposes. Being specific about your requirements helps appraisers provide accurate quotes and avoid scope creep.

Create a comprehensive asset list with as much detail as possible. Include equipment type, manufacturer, model, serial number, year of manufacture, current condition, and location. Add photos of high-value or unique items when possible. This preparation can reduce project time by 25-40%, creating immediate cost savings. For specialized equipment types, consider reviewing our guides on preparing agricultural equipment for appraisal or preparing for a construction equipment appraisal.

Research typical market values for your equipment beforehand. While you're not conducting the formal appraisal, having a general understanding of values helps you evaluate whether quotes are reasonable and gives you confidence during negotiations.

Identify multiple qualified appraisers with relevant experience in your equipment type. Look for proper credentials like ASA, AMEA, or ISA certifications, and verify they follow USPAP standards. Having multiple options strengthens your negotiating position and helps you understand market rates. Learn more about what to look for when choosing an appraiser.

Cost-Saving Tip: Providing a detailed asset list with photos can reduce appraisal time by 2-4 hours, potentially saving you $600-3,200 in fees while improving accuracy.

Effective negotiation focuses on creating win-win scenarios rather than simply demanding lower prices. The best tactics reduce the appraiser's costs or risks while maintaining the quality and defensibility you need.

Offer to provide additional documentation or preparation work to reduce the appraiser's time investment. This might include gathering maintenance records, organizing equipment for efficient inspection, or providing detailed photos and specifications. Your time investment can translate to significant fee reductions.

Consider alternative scope options that meet your needs at lower cost. Desktop appraisals using photos and documentation cost 40-60% less than full on-site inspections for many equipment types. Summary reports for internal use cost less than full narrative reports required for external purposes.

Negotiate timeline flexibility to avoid rush fees and optimize the appraiser's schedule. Projects with flexible deadlines often receive 10-15% discounts, especially during slower periods. You can also bundle multiple properties or locations to create economies of scale.

Request flat-fee proposals for well-defined projects to create cost certainty and negotiation leverage. When appraisers quote flat fees, they're motivated to work efficiently, and you can negotiate scope adjustments that provide mutual benefits.

Negotiation Insight: Appraisers often prefer flat-fee arrangements for standard equipment because it reduces their collection risk and provides predictable revenue. Use this preference to negotiate better overall pricing.

Consider long-term relationships for ongoing appraisal needs. Master service agreements or retainer arrangements typically provide 15-25% cost savings compared to individual project pricing, plus priority scheduling and consistent service quality.

Beyond direct fee negotiation, several alternative strategies can help you control appraisal costs while maintaining professional standards and defensibility.

For large inventories, consider sampling approaches where the appraiser inspects representative items and applies statistical methods to value the entire inventory. This approach can reduce costs by 50-70% while providing defensible results for many purposes.

Explore regional appraisal firms or networks that may offer competitive pricing compared to national firms. Local appraisers often have lower overhead costs and may provide more flexible pricing, especially for ongoing relationships. When comparing options, review our guide on comparing farm equipment appraisal services for insights that apply across equipment types.

When appropriate, supplement professional appraisals with internal estimates for planning purposes. While internal estimates can't replace certified appraisals for legal or compliance purposes, they can help you prioritize which assets need formal appraisal and optimize your overall approach.

Consider timing your appraisals strategically. Many appraisers offer better pricing during slower periods, typically in early winter or late summer. Planning ahead allows you to take advantage of these natural pricing cycles.

Equipment and machinery appraisals are significant investments, but they don't have to break your budget. By understanding cost drivers, preparing thoroughly, and negotiating strategically, you can secure professional, defensible appraisals at fair market rates. The key is balancing cost savings with the quality and compliance requirements your situation demands. To avoid common pitfalls that can increase costs, review our article on common mistakes to avoid when getting an equipment & machinery appraisal.

At AppraiseItNow, our certified appraisers work with clients to provide cost-effective, USPAP-compliant valuations that meet your specific needs and budget requirements.

Equipment appraisal fees typically range from $300-800 per hour or $150-500 per asset, depending on complexity, location, and report requirements. Desktop appraisals generally cost 40-60% less than full on-site inspections. The total cost varies based on the number of assets, equipment complexity, required valuation standards, and whether expert testimony may be needed for litigation purposes.

The biggest cost drivers include the number of assets being appraised, equipment complexity (specialized vs. standard machinery), on-site inspection requirements, travel distance, report depth needed, and turnaround time. Your asset list preparation quality can significantly impact costs - providing detailed information upfront including make, model, serial numbers, and condition can reduce project time by 25-40%.

Yes, you can negotiate fees by focusing on scope, timing, and preparation rather than simply asking for discounts. Effective strategies include providing comprehensive asset lists, choosing appropriate appraisal types (desktop vs. on-site), offering flexible scheduling, bundling multiple locations or assets, and establishing long-term relationships for volume discounts. Well-prepared clients routinely save 20-30% on appraisal fees.

Avoid cutting corners on fees for high-stakes situations like SBA lending, IRS compliance, litigation, or major business transactions where report defensibility is critical. In these cases, paying for a qualified, USPAP-compliant appraiser with proper credentials and experience is essential. The cost of an inadequate appraisal that fails scrutiny from banks, courts, or the IRS far exceeds any fee savings.