5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

These donations can take multiple forms, ranging from direct cash contributions to complex asset transfers. Monetary gifts are the most straightforward, typically involving cash, checks, or electronic transfers. However, donors can also contribute non-cash items like clothing, vehicles, securities, and even real estate.

Beyond financial support, charitable donations serve a critical role in addressing societal challenges. They provide essential funding for organizations working in areas such as education, healthcare, environmental conservation, and social justice. By contributing, donors become active participants in creating positive community change, supporting initiatives that might otherwise struggle to secure necessary resources.

The impact of charitable giving extends far beyond immediate financial support. These contributions help nonprofit organizations sustain their operations, develop innovative programs, and expand their reach to serve more individuals and communities in need. Moreover, donations foster a sense of collective responsibility and interconnectedness, demonstrating how individual actions can contribute to broader social progress.

For donors, charitable contributions offer potential tax advantages. Many jurisdictions allow tax deductions for gifts to qualified nonprofit organizations, which can help reduce overall tax liability. However, donors should maintain detailed documentation and, for significant non-cash donations, obtain professional appraisals to ensure proper valuation and tax compliance.

Ultimately, charitable donation represents a meaningful intersection of personal values, social responsibility, and practical financial strategy. Whether through monetary gifts, professional services, or tangible assets, each contribution has the potential to create meaningful, lasting impact.

From a tax perspective, the IRS mandates a qualified appraisal for non-cash contributions exceeding $5,000. This requirement isn't just bureaucratic red tape—it's a formal mechanism ensuring donors can accurately document and substantiate their charitable gifts. Proper documentation protects donors during potential tax reviews and helps maximize potential tax deductions.

Accurate valuation goes far beyond financial benefits. A professional appraisal introduces transparency and credibility to the donation process. Charitable organizations rely on precise documentation to validate contributions, demonstrate impact, and maintain financial accountability. When donors provide comprehensive appraisals, they empower nonprofits to more effectively communicate the tangible value of philanthropic support.

The expertise of a qualified appraiser cannot be overstated. These professionals understand nuanced market conditions, item-specific valuation methodologies, and current regulatory standards. Their specialized knowledge ensures donors receive a comprehensive, defensible assessment that reflects the true worth of their contribution.

Different types of donations—whether artwork, real estate, vehicles, or collectibles—require specific evaluation approaches. A professional appraiser brings specialized knowledge to assess each item's unique characteristics, historical context, and current market dynamics. This meticulous approach guarantees a fair, accurate representation of the donation's value.

By investing in a professional appraisal, donors transform their generosity into a strategic, well-documented contribution that benefits both the charitable organization and their personal financial planning.

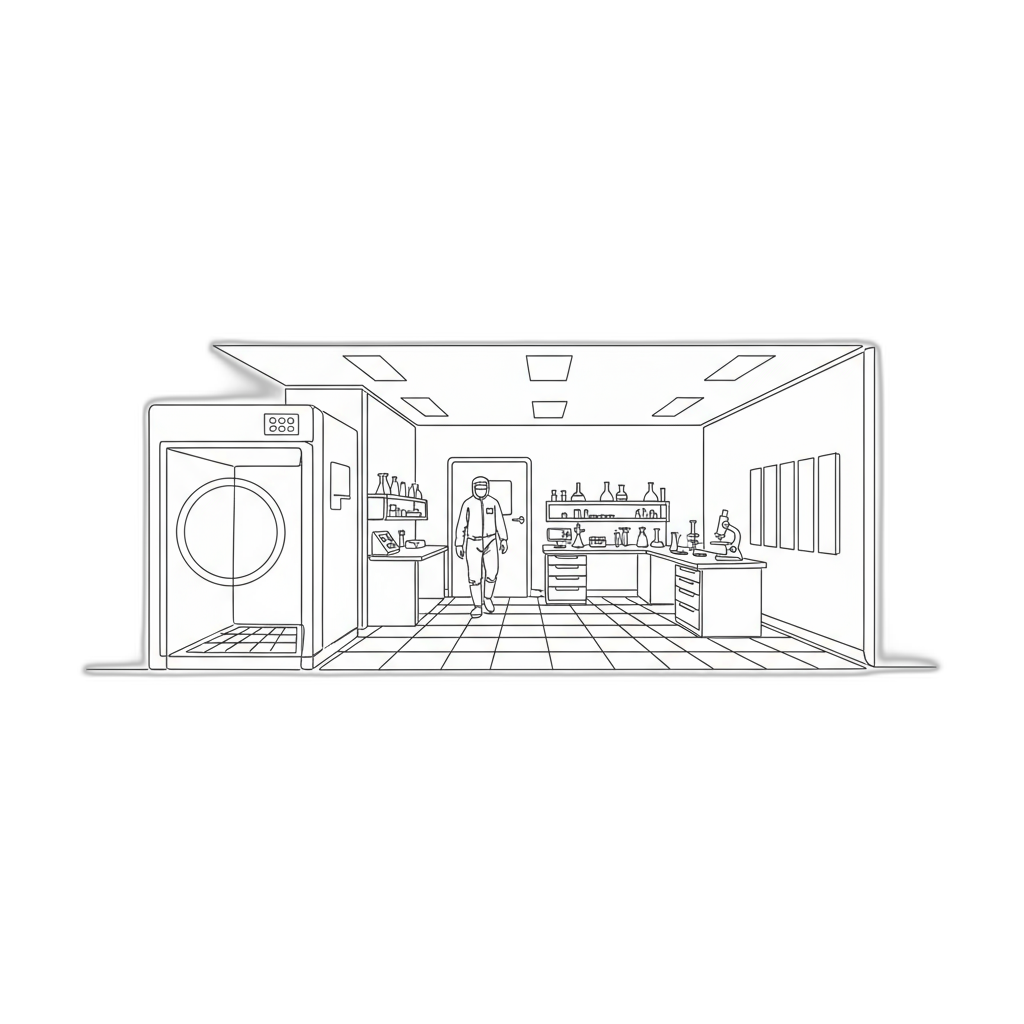

The process involves a systematic approach that considers multiple critical factors. Appraisers carefully evaluate each piece of equipment, examining its technological specifications, current market conditions, physical condition, and potential functional utility. They analyze the equipment's age, technological relevance, operational status, and overall performance capabilities to generate an accurate valuation.

Key considerations during the appraisal include detailed documentation of the equipment's make, model, serial number, and maintenance history. Appraisers conduct thorough market research to understand current demand, technological trends, and comparable sales in the scientific equipment marketplace. They assess the equipment's condition through rigorous inspection, determining its operational integrity and potential remaining useful life.

Multiple valuation methodologies may be employed, including cost approach, sales comparison, and income-based strategies. These techniques allow for a comprehensive assessment that considers replacement costs, current market values, and potential revenue generation capabilities.

Professional lab equipment appraisals serve critical functions across various sectors, including research institutions, pharmaceutical companies, educational facilities, and biotechnology organizations. They provide essential insights for financial reporting, strategic planning, insurance documentation, and potential transaction considerations.

The true value of a professional appraisal lies not just in generating a number, but in offering a comprehensive understanding of scientific assets that supports informed decision-making and strategic asset management.

Appraisers can now collect detailed information through multiple digital channels, including high-resolution photographs, comprehensive documentation, and interactive video consultations. This approach is particularly advantageous for stationary or complex equipment that may be challenging to relocate or physically inspect.

Advanced digital methods allow professionals to thoroughly examine equipment specifications, condition, age, and market value with remarkable precision. Live video conferencing platforms enable real-time interactions, where appraisers can conduct detailed visual assessments and ask targeted questions about the equipment's history and functionality.

The digital appraisal process offers significant benefits for laboratories, research institutions, and businesses with equipment distributed across multiple locations. By minimizing logistical constraints, these online approaches provide flexibility, reduce assessment time, and maintain the highest standards of professional evaluation.

Qualified appraisers utilize sophisticated techniques to ensure accurate valuations that reflect current market conditions, technological relevance, and specific equipment characteristics. Their expertise guarantees a comprehensive and reliable assessment that meets professional industry standards.

General lab equipment appraisers maintain broad competencies, capable of evaluating diverse instruments ranging from basic microscopes to sophisticated analytical equipment. Their comprehensive understanding allows them to provide holistic assessments that consider technological complexity, market demand, and current operational condition.

Specialized appraisers delve into specific scientific domains, developing nuanced expertise in particular equipment categories. Medical diagnostics, biotechnology, pharmaceutical research, and industrial quality control represent key areas where these professionals demonstrate exceptional technical acumen. Their targeted knowledge enables precise valuations that account for intricate technological specifications and industry-specific performance standards.

Industrial and regulatory-focused appraisers bring additional layers of complexity to equipment assessment. They integrate deep understanding of compliance requirements, safety standards, and operational protocols into their valuation methodologies. For organizations operating in highly regulated environments, these professionals provide critical insights that extend beyond monetary value.

Forensic equipment appraisers occupy a unique niche, understanding the specialized requirements of investigative laboratories. Their assessments consider not just monetary value, but also critical factors like evidentiary integrity, precision instrumentation, and specialized technological capabilities.

Each appraiser type contributes distinctive perspectives, ensuring comprehensive and accurate equipment valuations that support strategic decision-making across scientific and industrial sectors.

Financial clarity stands as a primary benefit of professional equipment assessment. Precise valuations enable accurate financial reporting, support tax compliance, and provide critical documentation for insurance purposes. Organizations can optimize their asset management strategies by understanding the true market value and depreciation trajectory of their scientific instrumentation.

Equipment appraisals become particularly crucial during significant business transitions such as mergers, acquisitions, or strategic equipment sales. They offer an objective, professionally validated perspective on asset worth, facilitating transparent negotiations and informed decision-making. For research institutions and corporate laboratories, this means maintaining financial integrity while supporting strategic planning.

Insurance and risk management represent another vital consideration. Accurate equipment valuations ensure appropriate coverage levels, protecting organizations from potential underinsurance or unnecessary premium expenditures. In scenarios of loss or damage, a credible appraisal expedites claims processes and supports fair compensation.

Legal scenarios also benefit significantly from professional equipment assessments. Whether addressing estate planning, partnership dissolutions, or asset divisions, a meticulously documented appraisal provides an impartial benchmark for determining equipment value.

Beyond immediate financial implications, equipment appraisals offer strategic insights into technological infrastructure. They help organizations understand depreciation patterns, plan capital expenditures, and make informed decisions about equipment upgrades or replacements.

Ultimately, a comprehensive lab equipment appraisal transcends simple monetary evaluation. It represents a strategic tool that empowers organizations to make data-driven decisions, maintain financial transparency, and optimize their technological investments.

Why Do Lab Equipment Donations Matter?

Lab equipment donations play a crucial role in advancing scientific research, education, and healthcare, particularly in underserved communities and institutions. By donating surplus or unused lab equipment, organizations can significantly impact the ability of schools, research facilities, and non-profits to conduct important studies and provide quality education.

Key Benefits of Lab Equipment Donations

Promoting Education and Training

- Enhance educational curricula by providing hands-on learning experiences

- Enable students to engage in practical experiments and research projects

- Develop critical thinking and innovation skills

- Prepare future scientists, engineers, and healthcare professionals

Supporting Research and Development

- Provide critical resources for research institutions with limited budgets

- Enable uninterrupted scientific research and investigation

- Accelerate the pace of scientific discovery

- Facilitate breakthroughs in medical, technological, and environmental fields

Enhancing Community Health

- Improve diagnostic and treatment capabilities in low-resource environments

- Support community hospitals and clinics

- Reduce healthcare disparities

- Increase access to quality healthcare services

Environmental Benefits

- Reduce waste through equipment repurposing

- Extend the lifecycle of scientific equipment

- Promote sustainable resource management

- Minimize environmental impact of discarded laboratory instruments

Lab equipment donations represent a powerful way for organizations to contribute to the greater good. By supporting education, research, healthcare, and sustainability, these contributions create meaningful impact across multiple sectors of society.

The Critical Role of Precise Valuation in Charitable Giving

Charitable donations of lab equipment represent a powerful mechanism for supporting research institutions, educational programs, and non-profit organizations. However, successful equipment donation extends far beyond simply transferring assets.

Why Precise Valuation Matters

A comprehensive and accurate valuation of donated lab equipment serves multiple critical purposes:

- Tax Implications: Precise assessments enable donors to claim appropriate tax deductions, incentivizing strategic philanthropic investments

- Organizational Transparency: Accurate appraisals demonstrate donor integrity and help receiving organizations communicate donation value to stakeholders

- Resource Allocation: Detailed valuations assist non-profits in making informed decisions about equipment usage, maintenance, and potential future applications

Key Benefits of Rigorous Valuation

- Financial Optimization: Donors can maximize potential tax benefits through meticulous documentation

- Institutional Credibility: Transparent valuations build trust between donors and recipient organizations

- Strategic Planning: Receiving institutions gain clear insights into donated asset value and potential research capabilities

Strategic Considerations

Effective lab equipment donation requires a comprehensive approach that considers:

- Current market value of specialized scientific equipment

- Operational condition and remaining functional lifecycle

- Potential research or educational impact

- Alignment with recipient organization's mission and capabilities

By recognizing the nuanced importance of precise valuation, donors and recipient organizations can transform equipment donations into meaningful contributions that drive scientific progress and innovation.

What Types of Lab Equipment Qualify for Donation?

Lab equipment serves as a critical resource in scientific research, education, and innovation. Organizations like hospitals, universities, and research facilities often have surplus equipment that can provide substantial value to charitable organizations. Understanding the types of lab equipment that qualify for donation enables informed decision-making while supporting those in need.

Qualifying Categories of Lab Equipment for Donation

1. Basic Laboratory Apparatus

- Essential foundational tools for laboratory settings

- Includes items such as:

- Beakers

- Flasks

- Pipettes

- Test tubes

- Critical for supporting educational institutions, especially in developing regions

2. Analytical Instruments

- Advanced equipment that enhances research and educational capabilities

- Includes sophisticated devices like:

- Spectrophotometers

- Chromatographs

- Microscopes

- Enables charities to expand scientific research and analytical potential

3. Medical Equipment

- Crucial for diagnostic and medical research purposes

- Key items include:

- Lab beds

- Centrifuges

- Incubators

- Biological safety cabinets

- Particularly beneficial for charitable clinics in underserved areas

4. Educational Tools

- Resources that facilitate scientific learning

- Encompasses:

- Classroom kits

- Interactive models

- Educational software

- Helps make scientific principles more accessible and engaging

5. Specialized Instruments

- Equipment designed for specific research domains

- Examples include instruments for:

- Genetics research

- Environmental science

- Can provide meaningful support even with limited application

Important Donation Considerations

When contemplating lab equipment donation, donors should carefully evaluate several key factors:

- Verify the equipment's operational status

- Ensure compliance with safety standards

- Confirm regulatory requirements are met

- Consult with potential recipient organizations

- Align donations with specific organizational needs

By thoughtfully donating lab equipment, organizations can simultaneously optimize their own space management and create meaningful educational and research opportunities for others.

Navigating the Lab Equipment Appraisal Journey

Navigating the lab equipment appraisal journey requires a strategic and meticulous approach to ensure accurate valuation and maximize potential tax benefits. Understanding the critical steps can transform a routine donation into a meaningful contribution.

Key Steps in Lab Equipment Appraisal

- Equipment Identification and Documentation

- Compile comprehensive details about each piece of equipment

- Record specific attributes including:

- Age

- Model number

- Technical specifications

- Maintenance history

- Current functional condition

- Selecting a Qualified Appraiser

- Choose an expert with specialized experience in lab equipment valuation

- Verify professional credentials and industry certifications

- Ensure alignment with professional appraisal standards

- Valuation Methodologies

Common Appraisal Approaches

- Market Approach: Comparative analysis of similar equipment sales

- Cost Approach: Replacement cost minus depreciation

- Income Approach: Potential revenue generation estimation

- Documentation and Compliance

- Prepare comprehensive documentation including:

- Detailed appraisal report

- High-quality equipment photographs

- Compliance certificates

- Maintenance and warranty documentation

- Ensure IRS documentation requirements are fully met

- Prepare comprehensive documentation including:

By meticulously following these steps, donors can confidently contribute valuable lab equipment to charitable organizations while securing appropriate tax considerations.

Finding the Right Expert for Your Lab Equipment Valuation

Finding the Right Expert for Your Lab Equipment Valuation

Selecting the right expert for lab equipment valuation is a critical step in the charitable donation process. The complexity of scientific instruments requires a nuanced approach to ensure accurate and fair assessment.

Key Considerations When Choosing an Appraiser

- Specialized Expertise in Lab Equipment

- Seek professionals with specific experience in scientific instrument valuation

- Look for experts familiar with diverse equipment types such as:

- Spectroscopy devices

- Centrifuges

- Microscopes

- Specialized research instruments

- Professional Credentials and Accreditation

- Verify membership in reputable professional organizations

- Prioritize appraisers associated with:

- American Society of Appraisers (ASA)

- International Society of Appraisers (ISA)

- Ensure adherence to strict professional standards and ethical guidelines

- Market Knowledge and Valuation Expertise

- Confirm deep understanding of current market trends

- Requires comprehensive insight into:

- Equipment depreciation rates

- Current market demand

- Technological obsolescence factors

- Comprehensive Documentation

- Request a detailed written report that includes:

- Precise valuation figures

- Detailed rationale for assessment

- Market comparisons

- Valuation methodology

- Ensure documentation meets tax deduction requirements

- Request a detailed written report that includes:

- Reputation and Client Feedback

- Research client testimonials and references

- Evaluate appraisers based on:

- Communication quality

- Professional thoroughness

- Overall client satisfaction

By carefully evaluating these critical factors, you can select a qualified appraiser who will provide an accurate and reliable valuation for your lab equipment donation.

Overcoming Appraisal Challenges: Insights and Solutions

Key Challenges in Lab Equipment Appraisal for Charitable Donations

Navigating the complex landscape of lab equipment appraisal for charitable donations requires a strategic approach and deep understanding of several critical challenges.

1. Specialized Equipment Valuation

- Lab equipment often features unique characteristics that complicate standard valuation methods

- Specialized instrumentation requires expert knowledge to accurately assess market value

- Factors such as equipment condition, technological relevance, and functional capability significantly impact valuation

2. Documentation and Record Keeping

- Comprehensive documentation is crucial for precise equipment appraisal

- Critical records include:

- Original purchase receipts

- Maintenance logs

- Previous valuation reports

- Missing or incomplete documentation can extend the appraisal process and reduce accuracy

3. Market Demand Assessment

- Not all lab equipment maintains consistent market value

- Demand varies based on:

- Technological advancement

- Specific scientific field

- Current research trends

- Thorough market research is essential to determine realistic equipment value

4. IRS Compliance Requirements

- Charitable donation appraisals must meet strict IRS guidelines

- Key compliance considerations include:

- Qualified appraiser certification

- Detailed valuation documentation

- Adherence to current tax regulations

- Professional guidance helps ensure successful tax deduction claims

Strategic Approach to Overcoming Appraisal Challenges

Successfully navigating lab equipment appraisal for charitable donations requires a proactive, comprehensive strategy. By understanding potential challenges and working with experienced professionals, organizations can maximize the value of their equipment contributions while maintaining regulatory compliance.

Careful preparation, detailed documentation, and expert consultation are the cornerstones of an effective lab equipment appraisal process.

Understanding Tax Benefits of Lab Equipment Donations

Donating lab equipment to charitable organizations offers substantial tax benefits while supporting critical research and educational initiatives. By understanding these advantages, individuals and businesses can maximize their philanthropic impact.

Tax Deduction Basics for Lab Equipment

- Donations may qualify for tax deductions based on the equipment's fair market value

- Fair market value represents the equipment's potential selling price on the open market

- Potential for higher tax deductions compared to original equipment purchase price

Strategic Benefits for Businesses

Organizations in scientific industries can leverage equipment donations to:

- Reduce taxable income

- Lower overall tax liability

- Support technological advancement in research sectors

Navigating the Donation Process

Documentation Requirements

- Obtain a professional equipment appraisal

- Verify receiving organization's 501(c)(3) non-profit status

- Maintain comprehensive donation records

Key Documentation Includes

- Detailed equipment appraisal

- Donation receipts

- Correspondence with charitable organization

IRS Compliance Considerations

For tax deductions exceeding $5,000, a formal professional appraisal is mandatory. This documentation substantiates the equipment's value and ensures compliance with tax regulations.

Conclusion

Strategic lab equipment donations enable donors to contribute meaningfully to scientific progress while enjoying significant financial benefits. Careful planning and thorough documentation are essential for maximizing these advantages.

Strategic Approaches to Donating Scientific Equipment

Strategic Planning for Scientific Equipment Donation

Donating scientific equipment offers a powerful opportunity to support educational and research institutions while promoting sustainability and innovation. By following a strategic approach, donors can maximize the impact of their contributions and navigate the donation process effectively.

Comprehensive Equipment Assessment

- Thoroughly evaluate the equipment's current condition and functionality

- Engage a professional appraiser specializing in scientific equipment

- Verify the equipment meets current safety and operational standards

- Document the equipment's current value for potential tax benefits

Identifying Ideal Recipients

Selecting the right organization is crucial to ensuring your donation creates meaningful impact:

- Research potential recipients' specific research or educational needs

- Align donation with organizations' current projects and missions

- Prioritize institutions that can directly utilize the equipment

- Consider educational institutions, research facilities, and non-profit organizations

Navigating Tax Considerations

Understanding the financial implications of equipment donation is essential:

- Obtain a professional appraisal to substantiate donation value

- Maintain detailed documentation of the donation

- Request a receipt from the recipient organization

- Consult a tax professional for guidance on charitable contribution deductions

Environmental and Community Impact

Donating scientific equipment extends beyond immediate benefits:

- Reduce electronic waste and promote equipment recycling

- Support educational and research initiatives

- Empower organizations with critical scientific resources

- Contribute to broader community development and innovation

By approaching equipment donation strategically, donors can create meaningful connections, support critical research, and contribute to sustainable community development.

Success Stories: Lab Equipment Donations That Made a Difference

Your Lab Equipment Donation: Answers to Key Questions

When considering the donation of lab equipment, various questions may arise that need addressing to ensure a smooth and beneficial process for both the donor and the recipient organization. Understanding these key aspects can significantly impact the donation experience.

Types of Acceptable Lab Equipment for Donation

Most institutions welcome a diverse range of lab equipment, including:

- Microscopes

- Analytical instruments

- Centrifuges

- Safety cabinets

- Specialized research equipment

Before making a donation, it's crucial to identify specific items that are acceptable and in demand based on the recipient organization's unique needs.

Determining Equipment Valuation

The valuation of lab equipment is critical for multiple purposes, including:

- Tax deduction calculations

- Insurance documentation

- Organizational record-keeping

Key Valuation Factors

Professional appraisers assess equipment value by considering:

- Current age of the equipment

- Overall physical condition

- Market demand

- Original purchase price

- Technological relevance

Tax Benefits of Lab Equipment Donation

Donating lab equipment can provide substantial tax advantages. The IRS allows tax deductions based on the fair market value of the equipment at the time of donation. To maximize these benefits:

- Retain all relevant documentation

- Collect official donation receipts

- Obtain professional appraisal reports

- Consult with a tax professional

Preparation Steps for Equipment Donation

Before finalizing your donation, follow these recommended steps:

- Conduct a comprehensive equipment inventory

- Assess the condition of each item

- Research potential recipient organizations

- Understand specific donation requirements

- Collaborate with a qualified appraiser

By carefully addressing these considerations, donors can make informed choices that enhance their charitable impact while ensuring compliance with all necessary guidelines and maximizing potential benefits.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)