5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

The agency's core responsibilities span five critical areas: tax collection, enforcement, taxpayer support, tax policy development, and refund management. Through tax collection, the IRS gathers federal taxes from individuals, businesses, and other entities, ensuring the financial foundation of government operations. Its enforcement division maintains system integrity by conducting audits, identifying potential tax evasion, and ensuring taxpayers meet their legal obligations.

Recognizing the complexity of tax regulations, the IRS provides comprehensive support through publications, online resources, and customer assistance. This commitment helps taxpayers navigate their financial responsibilities more effectively. Additionally, the agency plays a crucial role in developing and implementing tax policies by interpreting congressional legislation and creating clear, actionable regulations.

The IRS also manages the critical process of tax return processing and refund distribution, ensuring taxpayers receive their rightful returns efficiently. By leveraging technological advancements, the agency has modernized its approach, introducing e-filing options, online account management, and improved communication channels.

Beyond routine tax operations, the IRS handles specialized evaluations such as property valuation for tax purposes, including estate tax calculations and charitable contribution assessments. These precise valuations are essential for maintaining accuracy and fairness in the tax system.

At its core, the IRS represents more than a revenue collection agency. It is a vital institution that balances fiscal responsibility with taxpayer support, ensuring the financial mechanisms of the United States function smoothly and equitably.

The primary purpose of an IRS appraisal is to provide an objective, professionally validated assessment of an asset's fair market value. This valuation becomes essential in multiple contexts, from estate planning to charitable contributions and potential property transactions.

For individuals navigating complex tax landscapes, a professional appraisal offers multiple strategic advantages. It establishes a defensible, documented record of asset value that can withstand potential IRS scrutiny. Whether dealing with real estate, personal property, or significant financial holdings, an accurate appraisal helps taxpayers substantiate their reported values with credible, independent evidence.

The valuation process goes beyond simple number-tracking. It represents a comprehensive analysis that considers current market conditions, specific asset characteristics, and relevant economic factors. By obtaining a professional appraisal, individuals can confidently report asset values, minimize potential tax liabilities, and demonstrate transparency in their financial reporting.

Moreover, an appraisal provides crucial protection during potential tax audits. With detailed documentation from a qualified professional, taxpayers can effectively defend their reported asset values and reduce the risk of penalties or additional tax assessments.

Ultimately, an IRS appraisal is more than a procedural requirement—it's a strategic financial tool that enables precise, compliant, and informed tax management across diverse economic scenarios.

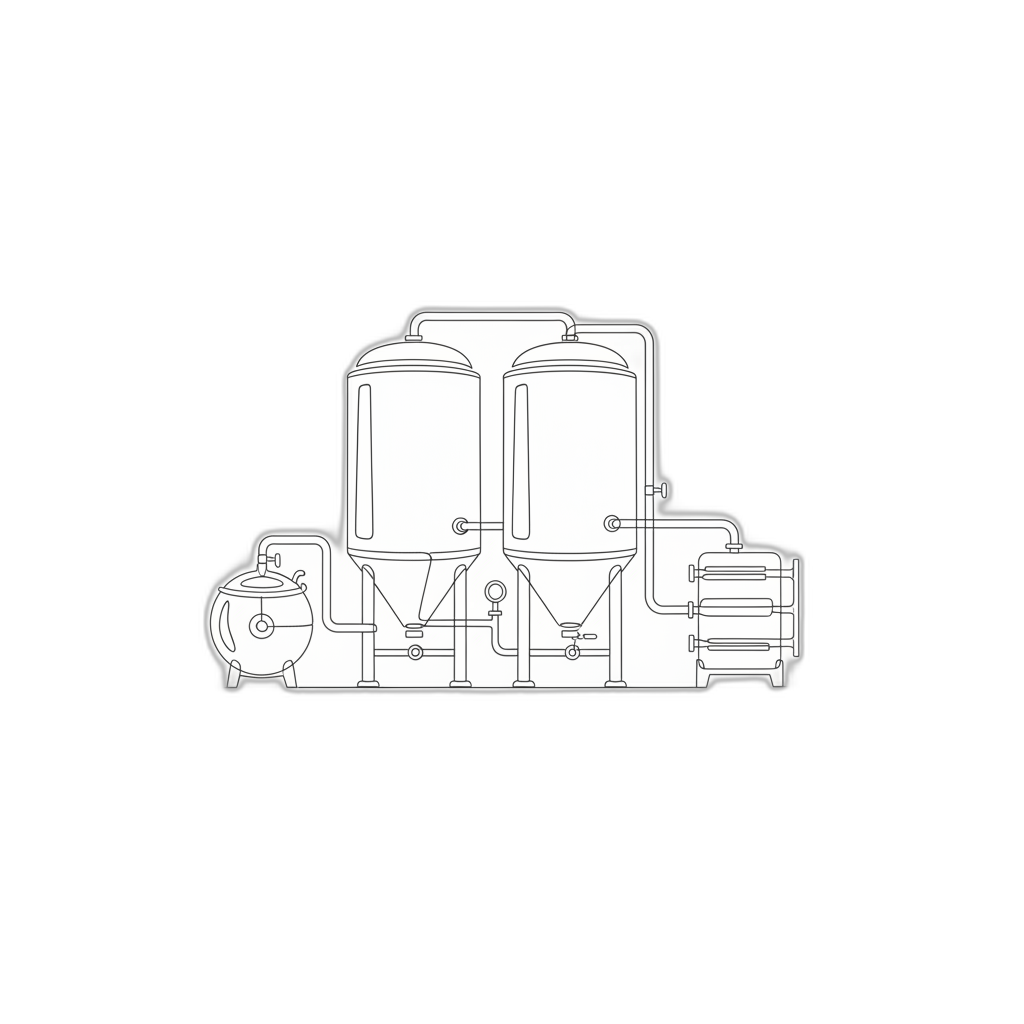

The valuation process involves a meticulous examination of diverse equipment types, ranging from intricate brewing systems and bottling lines to sophisticated dispensing mechanisms and quality control instruments. Professional appraisers conduct a thorough physical inspection, carefully assessing each asset's operational condition, maintenance history, technological specifications, and current market positioning.

Appraisers employ a multifaceted approach that integrates detailed on-site equipment evaluation with comprehensive market research. They analyze critical factors including equipment age, technological capabilities, brand reputation, original purchase value, and potential modifications or upgrades. This systematic methodology ensures an accurate and nuanced understanding of the equipment's true economic value.

The resulting appraisal provides stakeholders with a sophisticated financial snapshot, documenting equipment specifications, valuation methodology, current market trends, and a precise value estimate. Such detailed assessments support strategic decision-making for business owners, investors, financial institutions, and insurance providers by offering transparent, data-driven insights into asset valuation within the dynamic beverage industry landscape.

The process typically involves submitting detailed photographic evidence and comprehensive supplementary documentation via secure digital platforms. Professional appraisers utilize advanced technological tools to conduct thorough evaluations, ensuring precise and reliable assessments that meet rigorous industry standards.

Multiple engagement methods are available for clients seeking equipment valuation. These include asynchronous document submission, interactive video consultations, and real-time virtual equipment reviews using platforms like Zoom or Google Meet. Each approach allows appraisers to gather critical information and perform meticulous examinations comparable to traditional in-person assessments.

Key advantages of digital appraisal methodologies include enhanced accessibility, reduced logistical complications, accelerated turnaround times, and the ability to connect with specialized professionals regardless of geographical constraints. Modern appraisal techniques leverage advanced technological capabilities to deliver accurate, efficient, and professional evaluations tailored to unique equipment requirements.

By embracing digital assessment strategies, businesses can obtain comprehensive equipment valuations that maintain the highest standards of professional integrity and technical precision, all while minimizing time and resource investments traditionally associated with equipment appraisals.

General beverage equipment appraisers provide comprehensive assessments covering a wide range of production and service equipment. They possess broad knowledge about multiple equipment types, including kettles, fermentation tanks, bottling lines, and refrigeration units, enabling them to deliver well-rounded valuations based on comprehensive industry standards.

Specialized equipment appraisers concentrate on specific machinery categories, developing profound understanding of niche technologies. Their expertise might center on advanced water filtration systems, sophisticated carbonation equipment, or technical brewing machinery for specific beverage types like craft beer or artisan kombucha. These professionals deliver precise valuations by thoroughly understanding unique technological nuances and current market dynamics.

Operational appraisers take a holistic approach, evaluating equipment beyond its intrinsic value. They analyze operational efficiency, current condition, and potential business impact. By examining performance metrics and strategic potential, they help businesses understand the comprehensive economic value of their equipment investments.

Liquidation appraisers focus on determining fair market value during sales or asset disposition scenarios. They critically assess equipment's resale potential, considering current economic conditions and market demand. Their expertise is particularly valuable when businesses need to quickly and accurately value assets for potential sale.

Insurance appraisers specialize in establishing replacement values for insurance coverage. They work closely with insurance providers and beverage industry clients to ensure comprehensive protection, carefully evaluating replacement costs and potential depreciation for critical production equipment.

These diverse appraisal professionals collectively ensure that beverage industry equipment receives accurate, nuanced, and contextually appropriate valuation, supporting informed financial decision-making across different business scenarios.

Tax compliance represents a key driver for equipment appraisals. When businesses donate equipment valued over $5,000, a professional appraisal becomes essential for substantiating tax deduction claims. By documenting fair market value precisely, organizations can maximize potential tax benefits while maintaining full regulatory compliance.

Legal proceedings frequently necessitate accurate equipment valuations. During complex scenarios like business dissolutions, partnership disputes, or succession planning, a detailed appraisal serves as an objective, authoritative reference point. This impartial documentation can expedite negotiations and reduce potential conflicts by providing clear, defensible asset values.

Insurance protection represents another crucial consideration. Comprehensive equipment appraisals enable businesses to secure appropriate coverage levels, ensuring adequate financial protection against potential losses from theft, damage, or catastrophic events. An accurate valuation guarantees that insurance settlements reflect true equipment value, preventing potential undercompensation.

Financial institutions and potential investors rely heavily on professional equipment appraisals when evaluating lending or investment opportunities. A meticulously documented valuation enhances a business's credibility, providing transparent insights into asset quality and potential return on investment. These assessments can directly influence financing terms and overall financial strategy.

By embracing professional beverage equipment appraisals, businesses transform a routine assessment into a strategic financial tool. These evaluations provide nuanced insights that support informed decision-making, risk management, and long-term operational planning.

Why Do Beverage Equipment Appraisals Matter for IRS Compliance?

Understanding the Critical Role of Beverage Equipment Appraisals

Beverage equipment appraisals are a fundamental aspect of financial management and IRS compliance for businesses in the beverage production and distribution industry. These assessments provide critical insights that extend far beyond simple record-keeping.

Key Benefits of Professional Equipment Appraisals

- Strategic Tax Optimization

Accurate equipment valuations enable businesses to:

- Maximize legitimate tax deductions

- Correctly calculate equipment depreciation

- Reduce potential tax liabilities

- Comprehensive Asset Management

Professional appraisals empower businesses to:

- Track real-time asset values

- Make informed decisions about equipment upgrades

- Understand long-term asset performance

- Precise Financial Reporting

Reliable equipment valuations ensure:

- Accurate financial statements

- Enhanced investor confidence

- Improved credit ratings

- Estate and Succession Planning

Equipment appraisals are crucial for:

- Transparent asset valuation

- Equitable business transfer

- Clear succession strategies

- IRS Audit Preparedness

Professional appraisals provide:

- Documented asset values

- Credible evidence during tax reviews

- Protection against potential disputes

The Strategic Advantage of Regular Appraisals

Proactive equipment valuation is more than a compliance requirement—it's a strategic financial management tool. By maintaining up-to-date appraisals, businesses can navigate complex tax landscapes, optimize financial performance, and demonstrate fiscal responsibility.

While the process might seem complex, professional appraisals offer a clear path to financial clarity and regulatory compliance in the dynamic beverage industry.

The Critical Role of Precision in Beverage Equipment Valuation

In the realm of beverage production and distribution, the accurate valuation of equipment is paramount, especially when it comes to IRS purposes. Beverage equipment, ranging from brewing tanks to bottling lines, carries significant financial implications that necessitate a meticulous appraisal process.

Why Precision Matters in Beverage Equipment Valuation

Precision in valuation is crucial for several critical reasons:

- Tax Compliance: The IRS requires firms to report the fair market value of their assets, including beverage equipment. An accurate appraisal helps ensure compliance, mitigating the risk of penalties or audits.

- Financial Planning: Understanding the value of equipment can inform critical financial decisions. This information is vital for budgeting, financing, and investment strategies, enabling owners to gauge the potential return on investment or replacement costs effectively.

- Insurance Protection: Precise valuations directly impact insurance coverage. Insufficiently appraised equipment might not be fully covered in the event of a loss, while overvaluations could result in higher premiums.

- Sales and Merger Transparency: In scenarios involving equipment sales or business transitions, a fair and accurate appraisal is essential. It helps establish transparent transactions that reflect the equipment's true value, fostering trust between parties.

- Accurate Depreciation Tracking: Beverage equipment experiences wear and tear over time, and precise valuation aids in determining appropriate depreciation schedules. This impacts financial statements and can influence strategic investment decisions.

The Importance of Specialized Expertise

Given the complexities involved, beverage producers and distributors benefit significantly from engaging qualified appraisers who specialize in beverage equipment. These professionals possess the nuanced knowledge and expertise needed to navigate the specific intricacies of the industry, ensuring a reliable and objective assessment of equipment values.

By prioritizing precision in beverage equipment valuation, businesses can safeguard their investments and navigate the financial landscape with confidence and strategic insight.

What Equipment Falls Under IRS Appraisal Requirements?

When it comes to IRS appraisal requirements, understanding which equipment qualifies is essential for accurate reporting and compliance. The IRS often requires appraisals for a variety of beverage equipment, especially when determining fair market value for tax deductions, contributions, or estate settlements.

Common Types of Beverage Equipment Requiring Appraisal

- Brewing Equipment: This includes systems for beer production such as kettles, fermenters, and conditioning tanks. Valuing such equipment often requires specialized knowledge as these items can vary significantly in value based on age, brand, and condition.

- Bottling and Packaging Machines: Machines used for filling, capping, and labeling beverages are integral to production. The complexity and technology behind these machines can affect their value significantly, requiring an expert appraisal to assess their worth accurately.

- Coffee Machines: High-end espresso machines and commercial brewers can be quite valuable, especially those that are high-capacity and feature advanced technology. Appraisals can provide insights into their resale value and depreciation.

- Refrigeration Equipment: Walk-in coolers, display refrigerators, and ice machines are essential for beverage storage and display. Evaluating such equipment involves understanding energy efficiency ratings and maintenance history, both of which can influence market value.

- Draft Systems: Tap systems used in bars and restaurants for draft beer service often require appraisal due to their installation complexity and the specific configuration needed for optimal performance.

Importance of Accurate Appraisals

Having a certified appraisal for beverage equipment is crucial not only for IRS compliance but also for ensuring that business owners have an accurate understanding of their asset values. An accurate appraisal can help with strategic planning for upgrades or sales, enabling business owners to make informed financial decisions. Properly documented appraisals can also safeguard against audits and minimize the risk of tax-related disputes with the IRS.

Navigating IRS Guidelines for Equipment Valuation

Understanding IRS Equipment Valuation Guidelines

Navigating the complex landscape of IRS guidelines for equipment valuation is critical for businesses, particularly those in the beverage industry. The Internal Revenue Service has established comprehensive regulations that govern how assets, including specialized equipment, must be valued for tax-related purposes.

Why Accurate Valuation Matters

Precise equipment valuation delivers multiple strategic benefits:

- Provides a comprehensive view of business assets

- Enhances financial reporting accuracy

- Supports strategic tax planning

- Creates a defensible record in potential audit scenarios

Critical IRS Valuation Considerations

- Fair Market Value Principles

The IRS defines fair market value as the price at which equipment would exchange hands between a willing buyer and seller under normal market conditions. This standard ensures valuations reflect true economic realities.

- Equipment Assessment Factors

Multiple elements impact equipment valuation:

- Physical condition

- Equipment age

- Technological functionality

- Current market demand

- Potential obsolescence

- Documentation Requirements

Comprehensive documentation is paramount, including:

- Detailed maintenance records

- Original purchase invoices

- Previous professional appraisals

- Repair and upgrade documentation

- Professional Appraisal Standards

The IRS strongly recommends valuations performed by certified professionals who demonstrate:

- Relevant industry credentials

- Specialized equipment knowledge

- Comprehensive valuation expertise

- Adherence to professional appraisal standards

By meticulously following these guidelines, businesses can develop robust, compliant, and defensible equipment valuations that withstand rigorous IRS scrutiny.

Key Determinants of Beverage Equipment Value

Understanding the key determinants of beverage equipment value is crucial for businesses seeking accurate appraisals for IRS purposes. Multiple critical factors significantly influence the valuation of specialized beverage machinery and equipment.

Primary Value Determinants for Beverage Equipment

1. Equipment Age and Condition

- Newer equipment typically commands higher prices due to:

- Reduced maintenance requirements

- Enhanced operational efficiency

- Lower potential repair costs

- Older equipment experiences substantial depreciation, especially when:

- Showing significant wear and tear

- Requiring extensive repairs

- Lacking modern technological capabilities

2. Brand and Model Significance

- Reputable brands tend to retain higher value based on:

- Perceived quality

- Proven durability

- Strong market reputation

- Model-specific features impacting valuation:

- Energy efficiency

- Advanced technological integrations

- Specialized functional capabilities

3. Market Demand Dynamics

- Current market conditions dramatically influence equipment value

- Key factors affecting demand include:

- Seasonal industry trends

- Economic environmental conditions

- Overall industry growth trajectories

4. Functional Capability Assessment

- Equipment valuation heavily depends on operational functionality

- Higher-value equipment characteristics:

- Multifunctional capabilities

- Compatibility with current industry standards

- Specialized design for specific beverage production

5. Compliance and Certification Impact

- Equipment meeting regulatory standards typically commands premium valuations

- Critical certification considerations:

- Health and safety compliance

- Industry-specific regulatory requirements

- Enhanced marketability through standardization

6. Accessories and Component Evaluation

- Additional components can significantly enhance overall equipment value

- Comprehensive appraisal considers:

- Included accessories

- Upgraded technological components

- Complete operational setup

A comprehensive understanding of these determinants provides critical insights into beverage equipment valuation, ensuring a precise and informed appraisal process for IRS documentation.

How Does the Professional Appraisal Process Work?

Understanding the Professional Appraisal Process for Beverage Equipment

The professional appraisal process for beverage equipment involves a meticulous, structured approach designed to establish an accurate fair market value that meets IRS requirements.

Key Steps in the Beverage Equipment Appraisal Process

- Initial Consultation

- Detailed information gathering about the equipment

- Assessment of equipment characteristics including:

- Age

- Current condition

- Usage history

- Significant modifications

- Comprehensive Market Research

- Analysis of current market trends

- Examination of comparable equipment sales

- Consultation of industry-specific databases

- Review of recent market publications

- Detailed Physical Inspection

- On-site evaluation of equipment

- Assessment of:

- Operational efficiency

- Overall physical condition

- Cosmetic imperfections

- Potential depreciation factors

- Comprehensive Appraisal Report Preparation

- Detailed documentation of findings

- Explanation of valuation methodologies

- Rationale for assigned equipment value

- Compliance with IRS documentation standards

Benefits of Professional Equipment Appraisal

A professional appraisal serves multiple critical purposes beyond IRS compliance, including:

- Accurate asset valuation

- Support for financial planning

- Insurance coverage documentation

- Potential resale valuation

- Tax reporting accuracy

By following this rigorous process, businesses can ensure a transparent, reliable, and defensible valuation of their beverage equipment.

Selecting the Right Appraiser: What You Need to Know

Key Factors in Selecting the Right Beverage Equipment Appraiser

Choosing an appraiser for beverage equipment involves careful consideration of several critical factors to ensure accuracy, compliance, and comprehensive valuation.

Essential Qualifications to Evaluate

- Professional Credentials: Verify certifications from recognized appraisal organizations that demonstrate:

- Advanced industry training

- Adherence to professional standards

- Specialized expertise in equipment valuation

- Technical Expertise: Look for an appraiser with:

- Specific knowledge of beverage equipment types

- Understanding of industry-specific valuation nuances

- Experience with various equipment categories (brewing machines, bottling lines, refrigeration units)

Comprehensive Appraisal Methodology

A qualified appraiser should demonstrate:

- Clear, transparent valuation processes

- Detailed market analysis techniques

- Comprehensive depreciation assessment

- Ability to explain valuation rationale

Critical Compliance Considerations

- Regulatory Knowledge: Deep understanding of IRS guidelines for equipment appraisals

- Documentation Precision: Ability to prepare thorough, defensible appraisal reports

- Objectivity: Commitment to unbiased, market-driven valuations

Verification Strategies

- Check professional references

- Review client testimonials

- Verify industry reputation

- Request sample appraisal reports

The right appraiser goes beyond simple number generation, providing a comprehensive, compliant, and accurate assessment of your beverage equipment's true market value.

In-Person vs. Online Appraisals: Pros and Cons

Comparing In-Person and Online Appraisals for Beverage Equipment

When seeking an appraisal for beverage equipment with IRS implications, professionals must carefully evaluate the pros and cons of in-person and online appraisal methods.

In-Person Appraisals: Comprehensive Evaluation

Advantages

- Detailed Physical Inspection: Allows for comprehensive assessment of equipment condition, functionality, and specific characteristics

- Direct Professional Assessment: Enables real-time examination and immediate clarification of equipment details

- Nuanced Value Determination: Appraisers can identify subtle features or wear that might impact equipment valuation

Potential Drawbacks

- Higher Cost: Travel expenses and time investment can increase overall appraisal expenses

- Scheduling Complexity: Requires coordinating availability of both equipment owner and appraiser

- Geographic Limitations: May be challenging to find specialized appraisers in certain regions

Online Appraisals: Digital Efficiency

Advantages

- Rapid Processing: Quick submission and review of equipment documentation

- Flexible Scheduling: Can be completed without strict time or location constraints

- Broader Appraiser Network: Access to experts from diverse geographical locations

Potential Limitations

- Reduced Physical Examination: Limited ability to thoroughly inspect equipment details

- Communication Challenges: Potential for misinterpretation of equipment condition

- Dependence on Documentation Quality: Accuracy relies heavily on submitted photographs and descriptions

Choosing the Right Appraisal Approach

The optimal appraisal method depends on multiple factors, including:

- Equipment complexity

- Specific IRS documentation requirements

- Available resources and time constraints

- Desired level of detailed assessment

Carefully weighing these considerations will help ensure a comprehensive and accurate valuation that meets professional and regulatory standards.

Avoiding Costly Mistakes in Equipment Valuation

Avoiding Costly Mistakes in Equipment Valuation

When it comes to beverage equipment appraisal for IRS purposes, accuracy and diligence are critical. A single oversight or miscalculation can result in significant financial consequences, including potential penalties or disallowed tax deductions.

Key Strategies for Accurate Equipment Valuation

- Understand Depreciation Methods

Navigate the complexities of equipment valuation by mastering different depreciation approaches:

- Straight-line depreciation: Consistent annual reduction in value

- Declining balance depreciation: Accelerated value reduction in early years

- Carefully select the method that most accurately reflects your equipment's true economic value

- Assess Current Market Conditions

Market dynamics play a crucial role in determining equipment value:

- Track industry-specific trends

- Monitor supply chain developments

- Analyze technological advancements

- Evaluate shifts in consumer preferences

- Evaluate Equipment Condition and Maintenance

The physical state of your equipment directly impacts its valuation:

- Maintain comprehensive maintenance records

- Document all upgrades and repairs

- Recognize that well-maintained equipment retains higher value

- Work with Qualified Appraisers

Professional expertise is critical in achieving accurate valuations:

- Seek industry-specific appraisal experts

- Leverage specialized knowledge

- Identify nuanced valuation factors

- Understand IRS Appraisal Guidelines

Compliance is key to avoiding potential tax complications:

- Thoroughly review IRS documentation requirements

- Maintain meticulous records

- Ensure all valuations meet regulatory standards

By implementing these comprehensive strategies, you can develop a robust approach to beverage equipment valuation that minimizes financial risks and ensures compliance with tax regulations.

Understanding Tax Implications of Equipment Appraisals

When engaging in business transactions or tax planning, understanding the tax implications of equipment appraisals is essential, particularly for beverage equipment used in commercial settings. Appraisals serve not only as a valuation of assets but also play a significant role in determining tax liabilities and ensuring compliance with IRS regulations.

Key Tax Considerations for Beverage Equipment Appraisals

Asset Valuation Fundamentals

- Accurate appraisals establish the fair market value of beverage equipment

- The IRS requires valuations that reflect what a willing buyer would pay a willing seller under normal market conditions

- Fair market value is crucial for various tax purposes, including depreciation and potential tax deductions

Depreciation Optimization

- Beverage equipment is subject to depreciation as a non-cash expense that reduces taxable income

- Appraisals provide the foundational basis for calculating depreciation over the asset's useful life

- Proper depreciation calculations can lead to significant tax savings and improved cash flow management

Tax Reporting and Compliance

- Accurate appraisals are essential for compliance with IRS reporting requirements during equipment sales, donations, or transfers

- Proper documentation protects taxpayers from potential audits and penalties

- The IRS expects appraisals to be conducted by qualified professionals who adhere to established valuation standards

Audit Preparedness

- Comprehensive appraisal documentation serves as a critical safeguard during IRS audits

- Thorough records should outline the appraisal process, methodology, and results

- Well-documented valuations help justify estimated equipment values and mitigate potential challenges

Understanding the tax implications of beverage equipment appraisals is vital for navigating financial decisions, ensuring compliance, and optimizing tax positions. Proper appraisal practices not only align with IRS regulations but also contribute to informed business strategies.

Success Stories: Real-World Beverage Equipment Valuations

Your Top Questions Answered: Beverage Equipment Appraisals

Beverage equipment appraisals play a critical role in various financial and operational scenarios, particularly for IRS-related filings and tax deductions. Understanding the intricacies of these evaluations helps businesses and professionals navigate complex valuation processes effectively.

Key Insights into Beverage Equipment Appraisals

Purpose of Equipment Appraisals

An equipment appraisal provides an objective, certified assessment of fair market value that serves multiple critical functions:

- Ensures accurate tax reporting for IRS compliance

- Supports financial representations in business transactions

- Facilitates loan applications and insurance claims

- Documents precise asset valuation for strategic decision-making

Equipment Typically Appraised

Beverage equipment appraisals encompass a diverse range of machinery, including:

- Mixers and blenders

- Beverage dispensers

- Commercial refrigeration units

- Production line equipment

- Specialized brewing or processing machinery

Valuation Methodology

Professional appraisers employ comprehensive evaluation techniques that consider:

- Replacement cost of equipment

- Current market conditions

- Equipment's operational condition

- Potential income generation

- Comparable sales data

Optimal Timing for Appraisals

Consider obtaining a beverage equipment appraisal during:

- Business ownership transitions

- Merger or acquisition processes

- Financing or loan application periods

- Annual tax preparation

- Insurance coverage updates

Selecting a Qualified Appraiser

When choosing an equipment appraiser, prioritize professionals who demonstrate:

- Specialized industry experience

- Comprehensive understanding of beverage sector equipment

- Certification from recognized professional organizations

- Track record of accurate, defensible valuations

By understanding these key considerations, businesses can approach beverage equipment appraisals with confidence and strategic insight.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)