5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

The core objective is to provide a systematic, thorough assessment that captures both the quantitative and qualitative aspects of an asset's value. Property owners utilize this approach for numerous strategic purposes, including insurance documentation, estate planning, financial reporting, and potential sales transactions.

An effective inventory and appraisal process involves meticulous documentation that goes beyond simple list-making. It requires detailed examination of each item's condition, historical significance, current market trends, and potential future value. Professionals conducting these assessments bring specialized knowledge that transforms raw data into meaningful financial insights.

The methodology encompasses a comprehensive review that considers multiple valuation factors. These include an item's physical condition, age, rarity, market demand, and unique characteristics that might influence its overall worth. By combining rigorous documentation with expert evaluation, owners gain a clear, objective understanding of their asset portfolio.

Different asset categories require distinct appraisal approaches. Collectibles might be assessed based on historical provenance and market scarcity, while business equipment demands consideration of depreciation, functional utility, and current technological standards. This nuanced approach ensures that each asset receives a precise, contextually appropriate valuation.

Ultimately, inventory and appraisal serve as critical tools for informed decision-making. They provide clarity, reduce financial uncertainty, and offer a structured framework for understanding the true value of personal and business assets across diverse contexts.

Financial clarity emerges as a primary benefit, enabling precise asset valuation that supports robust financial planning. Businesses gain crucial insights for accurate financial reporting, while individuals can make more informed investment and budgeting decisions. This detailed assessment creates a transparent snapshot of asset worth.

Insurance protection represents another critical dimension. Documented appraisals provide definitive proof of asset values, ensuring appropriate coverage levels. In scenarios involving loss, damage, or unexpected events, a comprehensive appraisal becomes an invaluable safeguard, facilitating smoother claims processes and potentially mitigating financial risks.

Lending institutions heavily rely on professional appraisals when evaluating loan applications. Accurate asset documentation can significantly enhance borrowing potential, providing lenders with confidence in the collateral's true market value. This can translate into more favorable loan terms and increased financial flexibility.

For businesses contemplating sales or ownership transitions, an appraisal delivers objective, credible valuation metrics. It establishes a fair market baseline, reducing negotiation friction and providing transparent benchmarks for potential buyers and sellers. This professional assessment adds legitimacy to complex transaction processes.

Estate planning and legal settlements also benefit substantially from precise inventory appraisals. By establishing clear, defensible asset values, these assessments help minimize potential familial disputes and streamline inheritance distributions. They provide a neutral, professional perspective during emotionally complex transitions.

Tax compliance represents another crucial consideration. Accurate appraisals ensure proper reporting, helping individuals and organizations navigate complex regulatory landscapes. By maintaining meticulous documentation, one can mitigate audit risks and demonstrate financial transparency.

Ultimately, a professional inventory appraisal transcends mere number-crunching. It serves as a strategic tool, offering peace of mind and financial intelligence across personal and professional domains.

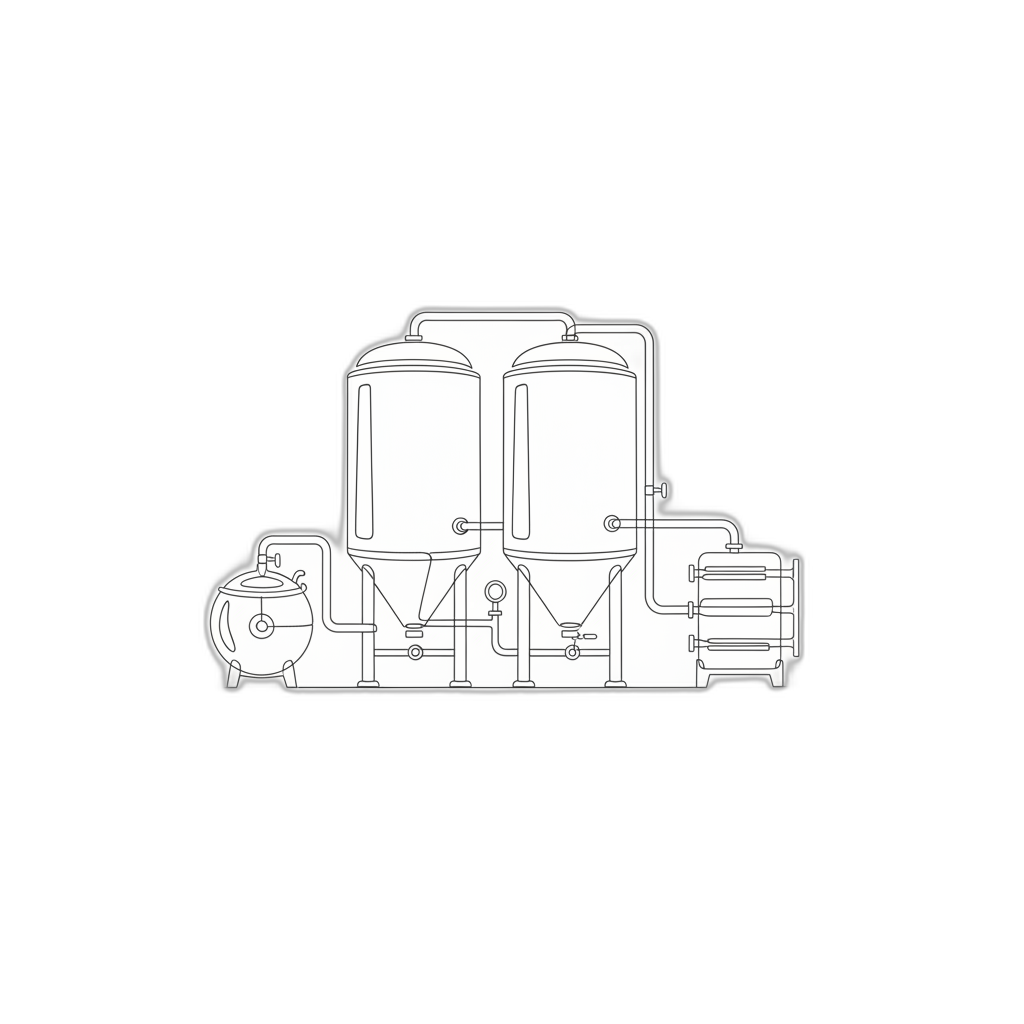

The valuation process involves a meticulous examination of diverse equipment types, ranging from intricate brewing systems and bottling lines to sophisticated dispensing mechanisms and quality control instruments. Professional appraisers conduct a thorough physical inspection, carefully assessing each asset's operational condition, maintenance history, technological specifications, and current market positioning.

Appraisers employ a multifaceted approach that integrates detailed on-site equipment evaluation with comprehensive market research. They analyze critical factors including equipment age, technological capabilities, brand reputation, original purchase value, and potential modifications or upgrades. This systematic methodology ensures an accurate and nuanced understanding of the equipment's true economic value.

The resulting appraisal provides stakeholders with a sophisticated financial snapshot, documenting equipment specifications, valuation methodology, current market trends, and a precise value estimate. Such detailed assessments support strategic decision-making for business owners, investors, financial institutions, and insurance providers by offering transparent, data-driven insights into asset valuation within the dynamic beverage industry landscape.

The process typically involves submitting detailed photographic evidence and comprehensive supplementary documentation via secure digital platforms. Professional appraisers utilize advanced technological tools to conduct thorough evaluations, ensuring precise and reliable assessments that meet rigorous industry standards.

Multiple engagement methods are available for clients seeking equipment valuation. These include asynchronous document submission, interactive video consultations, and real-time virtual equipment reviews using platforms like Zoom or Google Meet. Each approach allows appraisers to gather critical information and perform meticulous examinations comparable to traditional in-person assessments.

Key advantages of digital appraisal methodologies include enhanced accessibility, reduced logistical complications, accelerated turnaround times, and the ability to connect with specialized professionals regardless of geographical constraints. Modern appraisal techniques leverage advanced technological capabilities to deliver accurate, efficient, and professional evaluations tailored to unique equipment requirements.

By embracing digital assessment strategies, businesses can obtain comprehensive equipment valuations that maintain the highest standards of professional integrity and technical precision, all while minimizing time and resource investments traditionally associated with equipment appraisals.

General beverage equipment appraisers provide comprehensive assessments covering a wide range of production and service equipment. They possess broad knowledge about multiple equipment types, including kettles, fermentation tanks, bottling lines, and refrigeration units, enabling them to deliver well-rounded valuations based on comprehensive industry standards.

Specialized equipment appraisers concentrate on specific machinery categories, developing profound understanding of niche technologies. Their expertise might center on advanced water filtration systems, sophisticated carbonation equipment, or technical brewing machinery for specific beverage types like craft beer or artisan kombucha. These professionals deliver precise valuations by thoroughly understanding unique technological nuances and current market dynamics.

Operational appraisers take a holistic approach, evaluating equipment beyond its intrinsic value. They analyze operational efficiency, current condition, and potential business impact. By examining performance metrics and strategic potential, they help businesses understand the comprehensive economic value of their equipment investments.

Liquidation appraisers focus on determining fair market value during sales or asset disposition scenarios. They critically assess equipment's resale potential, considering current economic conditions and market demand. Their expertise is particularly valuable when businesses need to quickly and accurately value assets for potential sale.

Insurance appraisers specialize in establishing replacement values for insurance coverage. They work closely with insurance providers and beverage industry clients to ensure comprehensive protection, carefully evaluating replacement costs and potential depreciation for critical production equipment.

These diverse appraisal professionals collectively ensure that beverage industry equipment receives accurate, nuanced, and contextually appropriate valuation, supporting informed financial decision-making across different business scenarios.

Tax compliance represents a key driver for equipment appraisals. When businesses donate equipment valued over $5,000, a professional appraisal becomes essential for substantiating tax deduction claims. By documenting fair market value precisely, organizations can maximize potential tax benefits while maintaining full regulatory compliance.

Legal proceedings frequently necessitate accurate equipment valuations. During complex scenarios like business dissolutions, partnership disputes, or succession planning, a detailed appraisal serves as an objective, authoritative reference point. This impartial documentation can expedite negotiations and reduce potential conflicts by providing clear, defensible asset values.

Insurance protection represents another crucial consideration. Comprehensive equipment appraisals enable businesses to secure appropriate coverage levels, ensuring adequate financial protection against potential losses from theft, damage, or catastrophic events. An accurate valuation guarantees that insurance settlements reflect true equipment value, preventing potential undercompensation.

Financial institutions and potential investors rely heavily on professional equipment appraisals when evaluating lending or investment opportunities. A meticulously documented valuation enhances a business's credibility, providing transparent insights into asset quality and potential return on investment. These assessments can directly influence financing terms and overall financial strategy.

By embracing professional beverage equipment appraisals, businesses transform a routine assessment into a strategic financial tool. These evaluations provide nuanced insights that support informed decision-making, risk management, and long-term operational planning.

What Makes Beverage Equipment Appraisals Essential?

Essential Insights: Why Beverage Equipment Appraisals Matter

Beverage equipment appraisals are critical for businesses across the spectrum—from local cafes to international beverage manufacturers. These comprehensive assessments provide crucial insights into asset management and financial strategy.

Key Benefits of Beverage Equipment Appraisals

- Precise Inventory Management

Accurate appraisals enable businesses to:

- Track asset depreciation systematically

- Develop strategic financial planning

- Facilitate seamless accounting audits

- Maintain compliance with financial reporting standards

- Strategic Financial Reporting

Equipment valuations offer critical advantages such as:

- Creating transparent financial statements

- Supporting accurate tax assessments

- Potentially identifying tax optimization opportunities

- Comprehensive Insurance Protection

Reliable appraisals ensure:

- Appropriate insurance coverage

- Swift claims processing

- Fair replacement cost recovery

- Prevention of over/under insurance scenarios

- Informed Business Transactions

Equipment valuations support:

- Competitive pricing for sales

- Objective market value assessments

- Risk mitigation during acquisitions

- Transparent negotiation processes

- Technology and Efficiency Optimization

Regular appraisals help businesses:

- Evaluate equipment technological relevance

- Identify upgrade opportunities

- Maintain operational efficiency

- Stay competitive in evolving markets

By integrating comprehensive equipment appraisals, businesses can transform asset management from a routine task into a strategic advantage, ensuring financial clarity, operational excellence, and long-term sustainability.

Factors That Drive Beverage Equipment Valuation

Key Factors Influencing Beverage Equipment Valuation

When assessing the value of beverage equipment, multiple critical elements come into play. Understanding these factors is essential for businesses, investors, and individuals seeking accurate and comprehensive equipment valuations.

1. Equipment Age and Condition

- Newer equipment typically commands higher prices due to technological advancements and improved efficiency

- Equipment age directly impacts market value and depreciation rates

- Maintenance history and overall condition are crucial valuation determinants

- Well-maintained units can significantly preserve or enhance equipment value

2. Brand and Model Reputation

- Manufacturer reputation substantially influences equipment valuation

- Recognized brands known for quality tend to retain higher market values

- Specific models may gain increased desirability based on:

- Unique features

- Performance capabilities

- Historical market performance

3. Current Market Demand

- Industry trends directly impact equipment valuation

- Emerging beverage sectors can drive demand for specialized equipment

- Examples include rising trends in:

- Craft brewing

- Specialty coffee production

- Artisanal beverage manufacturing

4. Technological Innovation

- Advanced technological features significantly enhance equipment value

- Key technological attributes include:

- Automation capabilities

- Energy efficiency

- Sophisticated user interfaces

- Integration potential

- Modern equipment with cutting-edge technology commands premium valuations

5. Performance and Reliability Track Record

- Consistent production performance matters immensely

- Equipment with proven reliability attracts higher valuations

- Factors demonstrating reliability include:

- Consistent output quality

- Minimal downtime

- Long-term operational effectiveness

By comprehensively analyzing these interconnected factors, stakeholders can develop nuanced insights into beverage equipment valuation, enabling more informed decision-making for purchasing, selling, or insurance purposes.

The Critical Role of Professional Equipment Assessment

In today's competitive market, the accurate appraisal of beverage equipment is crucial for businesses seeking to optimize their inventory and maintain financial transparency. Professional equipment assessment plays a vital role in ensuring that companies can make informed decisions based on precise data.

Why Professional Equipment Assessment Matters

Understanding the value of beverage equipment is essential for several critical business functions:

Financial Planning and Strategic Insights

- Provides comprehensive insights into the actual worth of business assets

- Supports loan applications and investment strategies

- Enables strategic financial forecasting and budget planning

- Helps companies leverage equipment value for financial optimization

Comprehensive Business Protection

- Ensures accurate insurance coverage matching true equipment value

- Facilitates smoother claims processing in case of equipment loss

- Provides documented proof of asset valuation for risk management

Regulatory and Tax Compliance

- Supports precise asset reporting for tax assessments

- Enables proper depreciation allocation

- Helps avoid potential tax penalties

- Maintains transparent financial records

Strategic Equipment Management

- Establishes fair market value for equipment transactions

- Supports informed decision-making during equipment sales or acquisitions

- Helps determine optimal strategies for equipment disposal

- Provides objective valuation for resale, auction, or donation scenarios

By investing in professional equipment appraisal, businesses can enhance their financial stability, operational integrity, and strategic decision-making capabilities. A comprehensive assessment goes beyond mere number-crunching, offering valuable insights that support long-term business growth and financial health.

How Do Different Types of Beverage Equipment Impact Value?

Beverage equipment appraisal requires a sophisticated understanding of multiple value-determining factors across various equipment types. Each category of beverage machinery presents unique characteristics that directly influence its financial valuation.

Key Value Determinants for Beverage Equipment

Core Valuation Categories

- Functionality: Advanced equipment with specialized capabilities commands premium valuations

- High-end espresso machines with multi-brewing options

- Complex technological integration features

- Precision engineering for consistent performance

- Brand Reputation: Manufacturer credibility significantly impacts equipment value

- Established brands with proven reliability

- Long-term performance track records

- Manufacturing quality and innovation history

- Condition and Age Assessment: Physical state plays a critical role in valuation

- Maintenance history

- Technological currency

- Remaining operational lifecycle

- Market Demand Dynamics: Industry trends directly influence equipment value

- Current beverage consumption patterns

- Emerging technological preferences

- Sector-specific equipment requirements

Advanced Valuation Considerations

Professional appraisers meticulously evaluate equipment beyond surface-level assessments. Customization potential, technological sophistication, and adaptability to emerging market needs represent sophisticated valuation parameters that distinguish exceptional beverage equipment.

Strategic Valuation Approach

Comprehensive equipment appraisal demands a multi-dimensional perspective, integrating technical specifications, market trends, and potential future utility. By examining these interconnected factors, appraisers provide nuanced, accurate valuations that reflect true equipment worth.

Navigating the Comprehensive Appraisal Process

The appraisal of beverage equipment is a critical process that ensures accurate valuation for inventory management, financial reporting, and acquisition analysis. Understanding the comprehensive appraisal process can help businesses protect their investments and make informed decisions.

Understanding the Need for Appraisals

Beverage equipment, ranging from commercial brewing systems to specialized bottling lines, can vary significantly in value based on several key factors:

- Equipment age

- Current condition

- Specific brand reputation

- Current market demand

Appraisals are essential for multiple critical business purposes, including:

- Financial liquidity assessment

- Insurance documentation

- Taxation requirements

- Potential equipment sales

Types of Appraisal Approaches

Professional appraisers typically utilize two primary valuation methods:

Market Value Assessment

This approach focuses on determining equipment value based on recent sales of similar items in the current marketplace. Key considerations include:

- Recent comparable equipment sales

- Current market conditions

- Equipment-specific characteristics

Replacement Cost Valuation

This method evaluates the cost of replacing equipment with new items that offer similar:

- Functionality

- Quality

- Technical specifications

Selecting a Qualified Appraiser

Choosing the right professional is crucial for accurate equipment valuation. Critical selection criteria include:

- Specialized industry knowledge

- Comprehensive understanding of market trends

- Ability to evaluate equipment against established standards

- Relevant professional credentials

- Extensive experience in beverage equipment assessment

The Appraisal Process: Detailed Steps

1. Initial Inspection

On-site evaluations allow for comprehensive assessment of:

- Equipment condition

- Operational functionality

- Unique equipment features

2. Comprehensive Research

Appraisers conduct in-depth investigations including:

- Gathering data on comparable sales

- Analyzing current market conditions

- Tracking industry-specific trends

3. Detailed Reporting

The final appraisal report provides:

- Comprehensive findings

- Clear valuation methodology

- Official written assessment

Strategic Value of Equipment Appraisals

A well-executed appraisal enables businesses to:

- Make informed purchasing decisions

- Negotiate equipment sales effectively

- Assess financial stability

- Support long-term operational strategy

By understanding and implementing a comprehensive appraisal process, businesses can transform equipment valuation from a routine task into a strategic business tool.

Strategic Uses of Beverage Equipment Valuations

Strategic Uses of Beverage Equipment Valuations

Beverage equipment valuations provide critical strategic insights for stakeholders across the beverage industry. These comprehensive assessments go beyond simple monetary measurements, offering comprehensive guidance for strategic business decisions.

Key Strategic Applications

- Asset Management

- Enable precise tracking of equipment value over time

- Inform maintenance and replacement strategies

- Identify underperforming or obsolete assets

- Optimize operational efficiency and resource allocation

- Financial Planning and Reporting

- Provide critical data for balance sheet accuracy

- Support investment analyses

- Facilitate loan and financing negotiations

- Demonstrate comprehensive financial health

- Insurance Coverage

- Determine appropriate replacement cost coverage

- Streamline claims processing

- Ensure comprehensive protection against potential losses

- Support accurate risk assessment

- Mergers and Acquisitions

- Provide transparent asset valuation

- Facilitate fair negotiation processes

- Mitigate potential financial risks

- Support smooth business transitions

- Regulatory Compliance and Taxation

- Ensure accurate tax reporting

- Prevent potential penalty assessments

- Maximize potential tax deduction opportunities

- Maintain transparent financial documentation

By leveraging comprehensive equipment valuations, businesses can transform raw data into strategic insights, driving informed decision-making and supporting long-term organizational growth.

Selecting a Qualified Beverage Equipment Appraiser

Selecting a Qualified Beverage Equipment Appraiser

When it comes to valuing beverage equipment, the expertise of a qualified professional is essential. Appraising specialized equipment requires deep understanding of both technical specifications and market dynamics.

Key Considerations for Choosing an Appraiser

- Industry Knowledge and Experience

- Seek professionals with extensive background in beverage industry equipment

- Verify understanding of diverse equipment types including:

- Brewing systems

- Bottling lines

- Refrigeration units

- Specialized processing equipment

- Confirm ability to interpret current market trends and historical valuation data

- Professional Credentials

- Verify certification from recognized appraisal organizations

- Look for credentials such as:

- Certified Appraiser

- Accredited Senior Appraiser

- Professional equipment valuation designations

- Local Market Understanding

- Prioritize appraisers with regional market expertise

- Benefit from insights into:

- Local pricing trends

- Regional buyer preferences

- Equipment demand cycles

- Comprehensive Valuation Techniques

- Confirm use of multiple valuation approaches:

- Cost approach

- Sales comparison method

- Income-based valuation

- Ensures thorough and accurate equipment assessment

- Confirm use of multiple valuation approaches:

- Transparent Process

- Select appraisers who clearly communicate:

- Evaluation methodology

- Required documentation

- Expected timeline

- Demonstrates professional accountability

- Select appraisers who clearly communicate:

- Professional References

- Request and verify client testimonials

- Check for consistent positive feedback

- Validate reputation through industry references

By carefully evaluating these factors, you can select a qualified beverage equipment appraiser who provides reliable, precise, and comprehensive valuation services.

Protecting Your Business: Key Appraisal Insights

Why Beverage Equipment Appraisals Matter for Business Success

In the dynamic world of beverage production and distribution, comprehensive equipment valuation is more than just a financial exercise—it's a strategic business tool that provides critical insights and protection.

Five Essential Benefits of Professional Equipment Appraisals

- Strategic Financial Planning

Regular appraisals deliver precise market value assessments, enabling: • Accurate budget forecasting • Enhanced loan and investment opportunities • Clear understanding of asset depreciation

- Comprehensive Insurance Protection

Precise equipment valuations ensure: • Appropriate insurance coverage • Accurate claim settlements • Minimized financial risk in case of equipment loss or damage

- Competitive Market Intelligence

Equipment appraisals provide crucial insights into: • Current industry equipment values • Technology depreciation rates • Strategic inventory management

- Tax Compliance and Optimization

Professional appraisals support: • Accurate depreciation schedules • Maximized tax deduction opportunities • Regulatory compliance

- Strategic Business Transitions

Comprehensive valuations facilitate: • Informed sale or liquidation decisions • Accurate asset pricing • Negotiation leverage during business transitions

Building Business Resilience

By implementing regular equipment appraisals, beverage businesses can transform a routine assessment into a powerful strategic tool, enhancing operational efficiency, financial clarity, and long-term profitability.

Best Practices for Equipment Preservation and Value

Best Practices for Beverage Equipment Preservation

Maintaining beverage equipment requires a strategic approach that protects both functionality and value. By implementing comprehensive preservation techniques, businesses can maximize their equipment's longevity and appraisal potential.

Strategic Maintenance Protocols

- Comprehensive Routine Inspections

- Conduct systematic equipment assessments

- Identify potential wear and tear early

- Check critical components like hoses, seals, and connections

- Precise Cleaning Procedures

- Develop consistent cleaning protocols

- Use manufacturer-recommended cleaning agents

- Focus on high-residue areas like spouts and filters

- Professional Calibration

- Schedule regular equipment calibration

- Follow manufacturer servicing recommendations

- Maintain precision for measurement and dispensing equipment

Environmental Management

- Climate Control Strategies

- Monitor temperature and humidity levels

- Create stable storage environments

- Protect sensitive equipment components

- Protective Storage Practices

- Use dedicated storage areas

- Implement dust prevention measures

- Utilize protective covers and sheeting

Comprehensive Documentation

- Maintenance Record Keeping

- Create detailed maintenance logs

- Document all repairs and adjustments

- Maintain a comprehensive operational history

- Critical Document Preservation

- Retain original purchase receipts

- Preserve manufacturer manuals

- Compile evidence of equipment care

Technology and Value Optimization

- Strategic Equipment Enhancement

- Consider technological upgrades

- Retrofit older equipment with modern components

- Improve operational efficiency

- Proactive Equipment Management

- Regularly assess equipment value

- Compare maintenance costs versus replacement

- Make informed investment decisions

By implementing these comprehensive preservation strategies, businesses can protect their beverage equipment investment, maintain optimal performance, and ensure maximum value retention.

Compliance and Regulatory Landscape in Beverage Equipment Appraisals

Understanding the compliance and regulatory landscape is essential for any business involved in beverage equipment appraisal. Different jurisdictions impose various requirements to ensure that appraisals are conducted with integrity and reliability. Navigating these regulations is not only a matter of adherence but also critical for accurate valuation.

Key Compliance Areas

- Industry Standards: Beverage equipment appraisals must align with established valuation standards such as the Uniform Standards of Professional Appraisal Practice (USPAP). Familiarizing oneself with these standards helps ensure that appraisals are credible and meet professional benchmarks.

- Federal Regulations: Businesses must consider federal regulations that govern the beverage industry, which can influence the equipment's functionality and compliance status. Regulations from agencies like the Food and Drug Administration (FDA) can significantly impact the valuation process.

- State and Local Regulations: Different states and local jurisdictions may have specific guidelines that affect beverage equipment appraisal. Key considerations include:

- Appraiser licensing requirements

- Local health code compliance

- Safety regulation adherence

- Financial Reporting Standards: Companies must adhere to accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which require accurate and transparent reporting of equipment valuation.

Importance of Compliance

Non-compliance can result in severe consequences, including:

- Legal penalties

- Financial losses

- Reputational damage

Engaging a qualified appraiser with comprehensive knowledge of both the beverage industry and relevant regulations is crucial for successfully navigating this complex landscape. By maintaining strict compliance, businesses can:

- Ensure appraisals are valid and defensible

- Protect investments in beverage equipment

- Foster trust among stakeholders

- Support more informed decision-making in inventory management and asset allocation

Industry Trends Shaping Equipment Valuation

The beverage equipment appraisal industry is continuously evolving, with several key trends significantly influencing how professionals assess and value specialized machinery. Understanding these trends is crucial for business owners and stakeholders to make strategic decisions about their assets.

Key Industry Trends Impacting Equipment Valuation

Technological Innovations Driving Value

- Advanced automation transforming production capabilities

- IoT-enabled machines providing real-time performance tracking

- Smart technology increasing equipment efficiency and output

- Cutting-edge systems that reduce operational overhead

Sustainability as a Critical Valuation Factor

- Growing emphasis on eco-friendly manufacturing processes

- Equipment with energy-efficient design commands premium pricing

- Machines that minimize waste and reduce carbon footprint gain higher market value

- Regulatory pressures accelerating sustainable equipment development

Market Dynamics Influencing Equipment Worth

- Consumer preference shifts creating demand volatility

- Seasonal beverage trends impacting equipment utilization rates

- Regional market variations affecting equipment valuation

- Industry-specific economic cycles

Regulatory Compliance and Valuation

- Evolving health and safety standards

- New industry-specific compliance requirements

- Equipment upgrades necessitated by regulatory changes

- Compliance potential directly impacting equipment value

Comprehensive understanding of these dynamic trends enables stakeholders to accurately assess equipment value, optimize asset management strategies, and make informed investment decisions in the rapidly changing beverage equipment landscape.

Your Top Beverage Equipment Appraisal Questions Answered

Understanding Beverage Equipment Appraisal

Beverage equipment appraisal is a critical process for businesses in the food and beverage industry, providing crucial insights into the value and condition of essential machinery. This comprehensive evaluation helps organizations make strategic financial and operational decisions.

What is a Beverage Equipment Appraisal?

A beverage equipment appraisal is a detailed assessment that determines the monetary value of specialized machinery used in beverage production, storage, and distribution. Key aspects of this evaluation include:

- Comprehensive examination of equipment condition

- Analysis of current market value

- Consideration of equipment's operational efficiency

- Assessment of overall equipment performance

Why Are Appraisals Essential?

Businesses rely on equipment appraisals for multiple critical purposes:

- Financial reporting and transparency

- Insurance coverage validation

- Potential resale or equipment liquidation

- Merger and acquisition evaluations

- Tax and accounting compliance

Key Factors Influencing Equipment Value

Several crucial elements impact the valuation of beverage equipment:

- Brand Reputation: Established manufacturers often provide higher-value equipment

- Equipment Condition: Well-maintained machinery retains more value

- Technological Relevance: Current, efficient technology commands premium pricing

- Market Demand: Industry trends significantly influence equipment valuation

The Appraisal Process

Professional appraisers follow a comprehensive methodology:

- Conduct thorough visual equipment inspection

- Review maintenance and operational documentation

- Compare equipment with current market standards

- Analyze replacement and operational costs

- Prepare detailed valuation report

Selecting a Qualified Appraiser

Choosing the right professional is crucial for accurate valuation. Look for appraisers with:

- Industry-specific expertise

- Recognized certifications

- Comprehensive market knowledge

- Proven track record in equipment evaluation

By understanding the intricacies of beverage equipment appraisal, businesses can make informed decisions that optimize financial strategies and operational efficiency.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)