5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

The form captures a comprehensive range of assets, including both tangible and intangible property such as real estate, financial investments, business interests, cash holdings, and personal property. Its primary function is to calculate the gross estate value and identify any potential estate tax that may be owed based on the current federal exemption threshold.

Typically, the executor or personal representative of the deceased's estate is responsible for completing and filing Form 706. The filing becomes mandatory when the total estate value surpasses the current federal exemption limit, which can fluctuate annually based on current tax legislation.

The form itself is structured into multiple critical sections, each designed to provide a comprehensive financial overview. These include detailed reporting of gross estate value, allowable deductions such as outstanding debts and funeral expenses, precise tax computations, and documentation of any previous payments or available credits.

Importantly, Form 706 must be filed within nine months of the date of death, though extensions can be requested for filing purposes. While not every estate requires this filing, careful and accurate completion is essential to ensure proper tax compliance and avoid potential legal complications for estate beneficiaries.

Establishing a precise fair market value is paramount. The IRS requires an objective, professional evaluation of each asset at its value on the date of the decedent's death. This valuation becomes the cornerstone for calculating potential estate tax liabilities, ensuring transparency and accuracy in the reporting process.

Tax calculations demand meticulous attention to detail. Even slight variations in asset valuation can significantly impact the estate's tax burden. Undervaluing assets may trigger unexpected tax penalties, while overvaluation can unnecessarily strain the estate's financial resources. A comprehensive, professional appraisal minimizes these risks by providing a defensible and accurate assessment.

Legal protection is another crucial consideration. A professionally conducted appraisal creates a documented record that can preempt potential disputes among heirs, beneficiaries, or creditors. Should an IRS audit occur, this documentation serves as authoritative evidence, potentially shielding the estate from costly legal challenges.

Charitable contributions require equally rigorous valuation. When estates include philanthropic bequests, precise appraisals substantiate these donations for both IRS requirements and receiving organizations. This careful documentation can optimize tax considerations and ensure the donor's intentions are fully realized.

Asset distribution becomes more transparent with accurate valuations. An objective assessment provides a clear framework for equitable distribution among beneficiaries, reducing the potential for interpersonal conflicts during an already challenging time.

State-level regulations add another layer of complexity. Many states impose additional appraisal requirements that extend beyond federal mandates. Engaging professionals with comprehensive knowledge of both federal and state regulations ensures complete compliance across all jurisdictions.

Complex assets demand specialized expertise. Properties, businesses, unique collections, and other intricate holdings require nuanced evaluation. Qualified appraisers bring the necessary technical knowledge to accurately assess these specialized assets, providing a comprehensive and reliable valuation.

Ultimately, a professional appraisal for IRS Form 706 is more than a bureaucratic requirement. It represents a critical tool for responsible estate management, protecting the financial interests of both the estate and its beneficiaries while ensuring full compliance with regulatory standards.

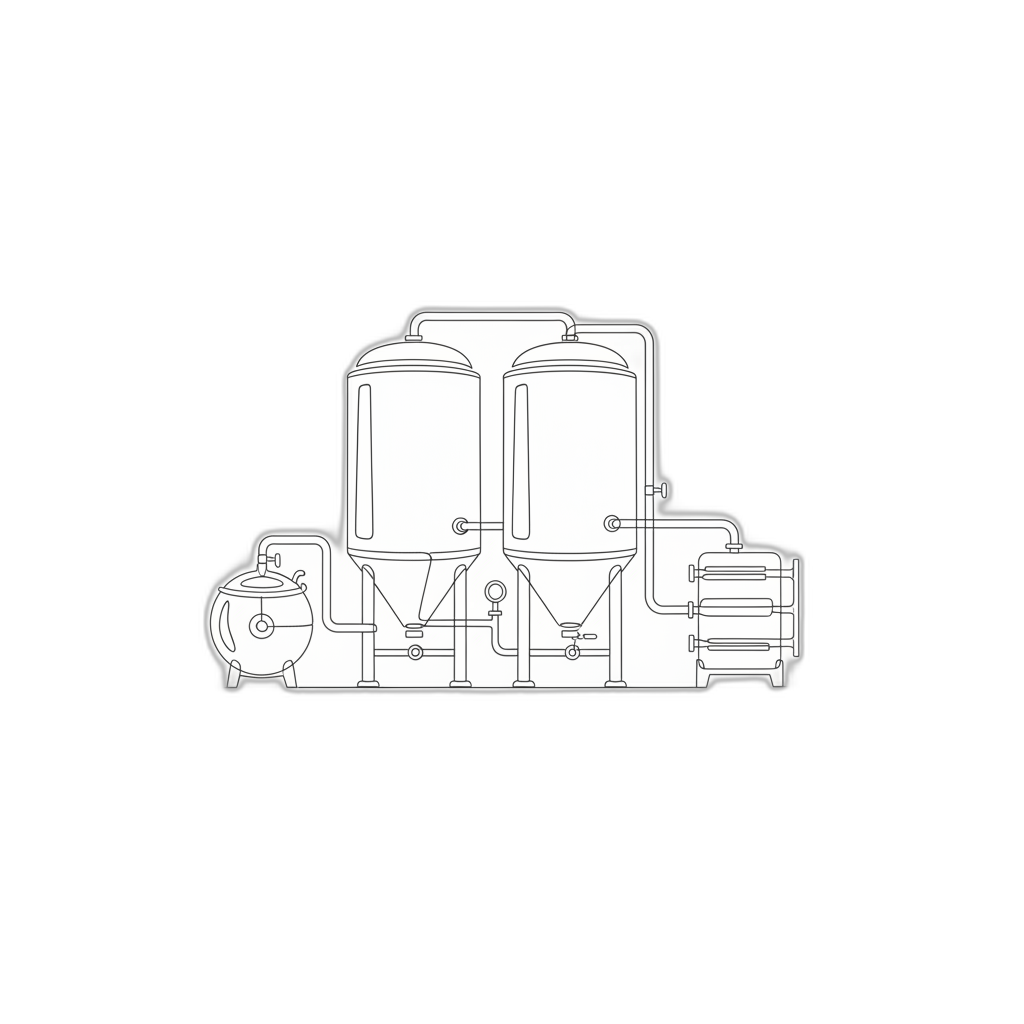

The valuation process involves a meticulous examination of diverse equipment types, ranging from intricate brewing systems and bottling lines to sophisticated dispensing mechanisms and quality control instruments. Professional appraisers conduct a thorough physical inspection, carefully assessing each asset's operational condition, maintenance history, technological specifications, and current market positioning.

Appraisers employ a multifaceted approach that integrates detailed on-site equipment evaluation with comprehensive market research. They analyze critical factors including equipment age, technological capabilities, brand reputation, original purchase value, and potential modifications or upgrades. This systematic methodology ensures an accurate and nuanced understanding of the equipment's true economic value.

The resulting appraisal provides stakeholders with a sophisticated financial snapshot, documenting equipment specifications, valuation methodology, current market trends, and a precise value estimate. Such detailed assessments support strategic decision-making for business owners, investors, financial institutions, and insurance providers by offering transparent, data-driven insights into asset valuation within the dynamic beverage industry landscape.

The process typically involves submitting detailed photographic evidence and comprehensive supplementary documentation via secure digital platforms. Professional appraisers utilize advanced technological tools to conduct thorough evaluations, ensuring precise and reliable assessments that meet rigorous industry standards.

Multiple engagement methods are available for clients seeking equipment valuation. These include asynchronous document submission, interactive video consultations, and real-time virtual equipment reviews using platforms like Zoom or Google Meet. Each approach allows appraisers to gather critical information and perform meticulous examinations comparable to traditional in-person assessments.

Key advantages of digital appraisal methodologies include enhanced accessibility, reduced logistical complications, accelerated turnaround times, and the ability to connect with specialized professionals regardless of geographical constraints. Modern appraisal techniques leverage advanced technological capabilities to deliver accurate, efficient, and professional evaluations tailored to unique equipment requirements.

By embracing digital assessment strategies, businesses can obtain comprehensive equipment valuations that maintain the highest standards of professional integrity and technical precision, all while minimizing time and resource investments traditionally associated with equipment appraisals.

General beverage equipment appraisers provide comprehensive assessments covering a wide range of production and service equipment. They possess broad knowledge about multiple equipment types, including kettles, fermentation tanks, bottling lines, and refrigeration units, enabling them to deliver well-rounded valuations based on comprehensive industry standards.

Specialized equipment appraisers concentrate on specific machinery categories, developing profound understanding of niche technologies. Their expertise might center on advanced water filtration systems, sophisticated carbonation equipment, or technical brewing machinery for specific beverage types like craft beer or artisan kombucha. These professionals deliver precise valuations by thoroughly understanding unique technological nuances and current market dynamics.

Operational appraisers take a holistic approach, evaluating equipment beyond its intrinsic value. They analyze operational efficiency, current condition, and potential business impact. By examining performance metrics and strategic potential, they help businesses understand the comprehensive economic value of their equipment investments.

Liquidation appraisers focus on determining fair market value during sales or asset disposition scenarios. They critically assess equipment's resale potential, considering current economic conditions and market demand. Their expertise is particularly valuable when businesses need to quickly and accurately value assets for potential sale.

Insurance appraisers specialize in establishing replacement values for insurance coverage. They work closely with insurance providers and beverage industry clients to ensure comprehensive protection, carefully evaluating replacement costs and potential depreciation for critical production equipment.

These diverse appraisal professionals collectively ensure that beverage industry equipment receives accurate, nuanced, and contextually appropriate valuation, supporting informed financial decision-making across different business scenarios.

Tax compliance represents a key driver for equipment appraisals. When businesses donate equipment valued over $5,000, a professional appraisal becomes essential for substantiating tax deduction claims. By documenting fair market value precisely, organizations can maximize potential tax benefits while maintaining full regulatory compliance.

Legal proceedings frequently necessitate accurate equipment valuations. During complex scenarios like business dissolutions, partnership disputes, or succession planning, a detailed appraisal serves as an objective, authoritative reference point. This impartial documentation can expedite negotiations and reduce potential conflicts by providing clear, defensible asset values.

Insurance protection represents another crucial consideration. Comprehensive equipment appraisals enable businesses to secure appropriate coverage levels, ensuring adequate financial protection against potential losses from theft, damage, or catastrophic events. An accurate valuation guarantees that insurance settlements reflect true equipment value, preventing potential undercompensation.

Financial institutions and potential investors rely heavily on professional equipment appraisals when evaluating lending or investment opportunities. A meticulously documented valuation enhances a business's credibility, providing transparent insights into asset quality and potential return on investment. These assessments can directly influence financing terms and overall financial strategy.

By embracing professional beverage equipment appraisals, businesses transform a routine assessment into a strategic financial tool. These evaluations provide nuanced insights that support informed decision-making, risk management, and long-term operational planning.

Understanding IRS Form 706 and Its Purpose

IRS Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is essential for reporting the value of a decedent's estate. This form is primarily used to determine estate tax liability and is generally required for estates with a net worth exceeding a designated federal threshold. The accurate completion of Form 706 is crucial, as it ensures compliance with federal tax laws and helps executors avoid future penalties or audits by the IRS.

Beverage equipment is often a significant asset within certain estates, particularly those involved in the food and beverage industry. As part of the valuation process required for Form 706, appraisals for beverage equipment must be thorough and precise. This involves assessing not only the current market value of the equipment but also understanding any depreciation, maintenance issues, and how these factors can impact the overall valuation of the estate. Properly appraising these assets can provide a clear picture of the estate's worth and help executors comply with all necessary tax obligations.

What is a Beverage Equipment Appraisal?

A beverage equipment appraisal is a professional assessment that determines the fair market value of equipment used in the production, distribution, and serving of beverages. This can include items like brewing systems, bottling machinery, bar equipment, and refrigeration units. Appraisals are essential for various scenarios, particularly for tax compliance, insurance coverage, or business transactions. Understanding the value of this equipment is crucial for stakeholders in the beverage industry, as accurate valuations help with informed decision-making and financial planning.

Conducting a beverage equipment appraisal typically involves a comprehensive evaluation of the equipment's condition, age, and market demand, along with a comparison to similar items in the market. Appraisers utilize various methodologies, including the cost approach, sales comparison approach, and income approach, to arrive at an accurate valuation. Ensuring that appraisals are performed by qualified professionals not only assures compliance with IRS requirements, especially for IRS Form 706, but also provides peace of mind for business owners and investors alike.

Why Beverage Equipment Appraisals Matter for IRS Form 706

Beverage equipment appraisals play a crucial role when it comes to IRS Form 706, which is the United States Estate (and Generation-Skipping Transfer) Tax Return. Accurate valuations of beverage equipment ensure compliance with tax regulations and help determine the fair market value of an estate. Given that the IRS requires thorough documentation of assets, having a properly appraised value for equipment can safeguard against potential disputes and penalties in the future. This becomes particularly important in cases where the equipment represents a significant portion of the estate's overall value.

Furthermore, a detailed appraisal not only supports tax filings but also provides essential context during estate planning and distribution. Beneficiaries and trustees can make informed decisions about the management or sale of beverage equipment based on its appraised value. This transparency helps ensure that assets are fairly divided, reducing the likelihood of conflicts among heirs. Ultimately, investing time in a professional appraisal can enhance the efficiency of the estate settlement process, offering peace of mind for all parties involved.

Types of Beverage Equipment Subject to Appraisal

Beverage equipment encompasses a wide range of machinery and tools utilized in the production, preservation, and serving of drinks in both commercial and residential settings. This can include items such as brewing systems, carbonators, cooling equipment, and even glassware designed for specific beverages. Each type of equipment has its own unique valuation factors based on condition, brand, age, and market demand, all of which are essential considerations for appraisers when determining fair market value for IRS Form 706 purposes.

Additionally, specialized beverage equipment may also be involved in the appraisal process, including kegging and bottling lines used in brewing operations, espresso machines for coffee businesses, or advanced filtration systems for wine production. The complexity and specificity of each piece of equipment can influence not only its value but also the methods used for appraisal. Understanding the different categories of beverage equipment enables stakeholders to prepare better for potential appraisals and helps ensure accurate reporting for estate tax purposes.

Determining the Value of Beverage Equipment

Determining the value of beverage equipment for IRS Form 706 requires a thorough understanding of several key factors. First, appraisers must consider the specific type of equipment being evaluated, which can range from commercial coffee machines to sophisticated brewing systems. Understanding the equipment's intended use and market demand is crucial, as different types of beverage businesses may require distinct machinery that influences value significantly.

Secondly, the condition and age of the equipment play a pivotal role in valuation. Factors such as wear and tear, maintenance history, and any modifications or upgrades can affect how much potential buyers are willing to pay. Appraisers evaluate these elements meticulously to ensure that the valuation reflects not only the equipment's current state but also its future earning potential within a business context.

Lastly, the market trends and economic conditions related to the beverage industry must be taken into account. An appraisal should consider recent sales of similar equipment and adjust for any fluctuations in supply and demand. By weaving together insights from various sources, including industry reports and local market conditions, appraisers can provide a comprehensive and fair market value that meets IRS requirements while serving the interests of business owners.

The Appraisal Process: What to Expect

The appraisal process for beverage equipment begins with identifying the specific assets that need to be evaluated. This step often involves gathering detailed information about the equipment, including its make, model, age, and condition. An appraiser will typically conduct an on-site inspection to assess these factors firsthand, ensuring a thorough evaluation and accurate valuation tailored to your equipment's unique attributes.

Once the equipment has been inspected, the appraiser will analyze relevant market data to determine a fair market value. This analysis often considers various valuation methods, such as sales comparison, cost approach, or income projection, to yield a comprehensive understanding of the equipment's worth. The appraiser's expertise in the beverage industry and knowledge of current market trends play a crucial role in this process, helping to provide an accurate representation of value.

Following the analysis, the appraiser compiles a detailed report that outlines the findings and the rationale behind the valuation. This report is essential for IRS Form 706, as it substantiates the claimed value of the beverage equipment for estate tax purposes. It is important for this document to be professional, clear, and compliant with IRS requirements, ensuring that it holds up under scrutiny and supports your estate planning objectives.

Choosing the Right Appraiser for Beverage Equipment

Selecting the right appraiser for beverage equipment is crucial to ensure a fair and accurate valuation for IRS Form 706 requirements. It’s important to find an appraiser with specific experience in the beverage industry, as this specialization allows them to accurately assess the value of both unique equipment and any associated assets. Their familiarity with the market trends and depreciation rates of beverage equipment can significantly affect the final appraisal outcome. A qualified appraiser should also be well-versed in the IRS’s standards for appraisals, ensuring compliance with all formalities and requirements.

In addition to experience, consider the appraiser's credentials and professional affiliations. Reputable appraisers often hold certifications from recognized appraisal organizations, which can serve as an assurance of their expertise, ethical standards, and professional practice. Don’t hesitate to ask for references or examples of past appraisals they have conducted, as this can give insight into their working style and reliability. Ultimately, the right appraiser will not only provide an accurate valuation but will also guide you through the process, resolving any questions or concerns you may have along the way.

Common Mistakes to Avoid in Beverage Equipment Appraisals

One of the most common mistakes in beverage equipment appraisals is underestimating the importance of accurate documentation. Detailed records of purchase prices, maintenance history, and any modifications made over time are crucial for establishing the fair market value. Without this information, appraisers may inadvertently assign an inaccurate value to the equipment, which can lead to issues during tax assessments or business valuations.

Another prevalent error is failing to consider market trends and demand for specific types of beverage equipment. The value of equipment can fluctuate significantly based on industry trends, technological advancements, and consumer preferences. Appraisers should be aware of these trends to avoid assigning outdated values that do not reflect the current market landscape, ultimately leading to inflated or deflated asset valuations.

Lastly, overlooking the importance of professional expertise can derail the appraisal process. Engaging with qualified appraisers who have experience in the beverage industry is essential for obtaining accurate valuations. These professionals possess the necessary skills and knowledge to properly assess equipment conditions and market positions, ensuring a thorough appraisal that stands up to regulatory scrutiny or investment considerations.

Documentation Needed for Beverage Equipment Appraisals

When preparing for a beverage equipment appraisal, comprehensive documentation is essential to ensure an accurate and fair assessment. This documentation typically includes purchase invoices, manuals, and maintenance records that provide insight into the equipment's condition and operational history. Additionally, any previous appraisals or valuations can serve as a vital reference point, helping appraisers assess depreciation and market value.

Photographs of the equipment, taken from various angles and showing any notable wear or modifications, can also be beneficial. These images can give the appraiser a clearer understanding of the equipment's physical state and its suitability for ongoing use. Furthermore, maintaining documentation of any recent upgrades or renovations can provide context that influences the appraiser's evaluation.

Lastly, a detailed description of the equipment, including brand, model, age, and usage patterns, is crucial for a thorough appraisal process. This information helps appraisers understand how the equipment fits within current market trends and its potential resale value. Having all of this documentation organized and readily available can significantly expedite the appraisal process and improve the accuracy of the final report.

How Beverage Equipment Appraisals Impact Estate Taxes

Beverage equipment appraisals play a crucial role in determining the fair market value of assets for IRS Form 706, which is essential for estate tax calculations. When a business owner passes away, the IRS mandates that all assets, including specialized equipment, be accurately valued to establish the total estate value. Beverage equipment, such as brewing tanks, kegs, and dispensers, often entails unique valuation challenges due to their specific uses and the market demand. An accurate appraisal not only ensures compliance with federal tax regulations but also helps in making informed decisions about the future distribution of the estate's assets.

In the context of estate tax obligations, having a professional appraisal of beverage equipment can significantly affect the ultimate tax burden faced by the estate. Underestimating or overestimating the value of these assets can lead to potential disputes with the IRS and result in penalties or excessive tax liabilities. Furthermore, a well-documented appraisal provides clarity and substantiates the value placed on these assets, which can be beneficial in negotiations with heirs and beneficiaries. Ultimately, leveraging a thoroughly conducted appraisal process is essential for estate planning and can provide peace of mind during an emotionally challenging time.

Case Studies: Real Examples of Beverage Equipment Appraisals

Beverage equipment appraisals often involve a variety of machines and tools essential for the production and distribution of drinks, ranging from brewing systems to bottling lines. In one notable case, a regional brewery sought an appraisal of its custom brewing equipment as part of a succession plan. The appraiser utilized market data to evaluate the unique features of the equipment, establishing a fair market value that reflected both its operational capacity and specialized modifications that enhance productivity.

In another example, a large beverage distributor required an appraisal for its extensive fleet of vending machines, which included state-of-the-art technology integrated with cashless payment systems. The appraiser meticulously assessed not only the physical condition of each machine but also analyzed the revenue history and market demand for specific beverage products within targeted locations. This comprehensive approach ensured an accurate depiction of the equipment's value for IRS Form 706, allowing the client to accurately report their estate's worth while also preparing for potential tax implications.

Frequently Asked Questions About Beverage Equipment Appraisals

Beverage equipment appraisals are essential for accurately determining the value of assets such as coffee machines, brewing systems, and vending equipment, especially when preparing IRS Form 706 for estate tax purposes. Accurate appraisals help ensure compliance with tax regulations and can also provide a clear understanding of the asset's market value. This information is crucial not only for tax liability but also for effective estate planning and asset distribution among heirs.

When it comes to beverage equipment, factors such as age, condition, brand, and market demand play a significant role in the appraisal process. Professional appraisers often utilize comparable sales data, industry standards, and the specific characteristics of the equipment to derive a fair market value. It’s important for business owners and executors to understand that beverage equipment can depreciate over time, which may affect its overall valuation.

Additionally, engaging with a qualified appraiser who has experience in the beverage industry can provide deeper insights into the value of specialized equipment. This expertise not only enhances the accuracy of the appraisal but also ensures that all relevant aspects of the equipment are considered. As beverage technologies evolve and consumer preferences shift, staying informed about market trends is vital for a comprehensive appraisal, particularly during estate planning and tax preparation.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)