About Beverage Equipment Appraisals for Loan Collateral

Frequently Asked

Questions

No Frequently Asked Questions Found.

What is Loan Collateral?

Loan collateral represents a fundamental mechanism in financial lending where borrowers pledge specific assets to secure a loan, providing lenders with a critical risk mitigation strategy. This strategic financial arrangement enables borrowers to access funds while offering lenders a tangible form of protection against potential default.

The concept operates on a straightforward principle: if a borrower fails to repay the loan according to agreed terms, the lender retains the legal right to seize and liquidate the pledged asset to recover their financial losses. These assets can range widely, including real estate properties, vehicles, cash accounts, business inventory, equipment, and investment portfolios.

For borrowers, utilizing collateral can yield significant advantages. Secured loans typically feature more attractive terms, such as reduced interest rates and potentially higher borrowing limits. Individuals with limited credit history or lower credit scores may find collateral particularly beneficial, as it increases their likelihood of loan approval by providing lenders with additional confidence.

However, borrowers must carefully evaluate their financial capabilities before pledging assets. The potential consequences of defaulting—losing a valuable asset like a home or vehicle—underscore the importance of thorough financial planning and realistic repayment assessments.

Lenders view collateral as a critical risk management tool, enabling them to extend credit more confidently and under more favorable conditions. By having a tangible asset backing the loan, financial institutions can mitigate potential monetary losses and create a more structured lending environment.

The dynamics of loan collateral reflect a nuanced balance between borrower needs and lender protections, representing a sophisticated approach to managing financial risk in lending transactions.

Why do I need an appraisal for Loan Collateral?

When seeking a loan, lenders typically require collateral to secure the borrowing, making a professional appraisal a critical component of the lending process. An appraisal provides an objective and comprehensive evaluation of an asset's current market value, serving multiple essential functions for both lenders and borrowers.

The primary purpose of a collateral appraisal is to establish a precise and unbiased assessment of an asset's worth. This professional valuation ensures lenders can accurately gauge the potential risk associated with extending credit. By determining the true market value, financial institutions can make informed decisions about loan amounts, terms, and potential recovery strategies in case of default.

For borrowers, an appraisal offers transparency and credibility in the lending process. It provides documented evidence of an asset's value, which can potentially strengthen negotiation positions and lead to more favorable loan terms. The appraisal serves as an independent verification that protects both parties' interests by establishing a clear, professional understanding of the asset's economic standing.

Beyond immediate lending considerations, an appraisal also captures broader market insights. Professional appraisers analyze current market trends, potential asset depreciation, and comparative values, which can offer valuable context about the collateral's long-term financial implications.

Regulatory compliance represents another critical aspect of collateral appraisals. Financial institutions must adhere to strict guidelines that mandate thorough due diligence in credit extension. A comprehensive appraisal helps satisfy these requirements, mitigating potential legal and financial risks for all involved parties.

Ultimately, a professional appraisal transforms a potentially subjective asset valuation into an objective, defensible assessment. It provides a foundation of trust, accuracy, and informed decision-making in the complex landscape of loan collateralization.

What is a Beverage Equipment appraisal?

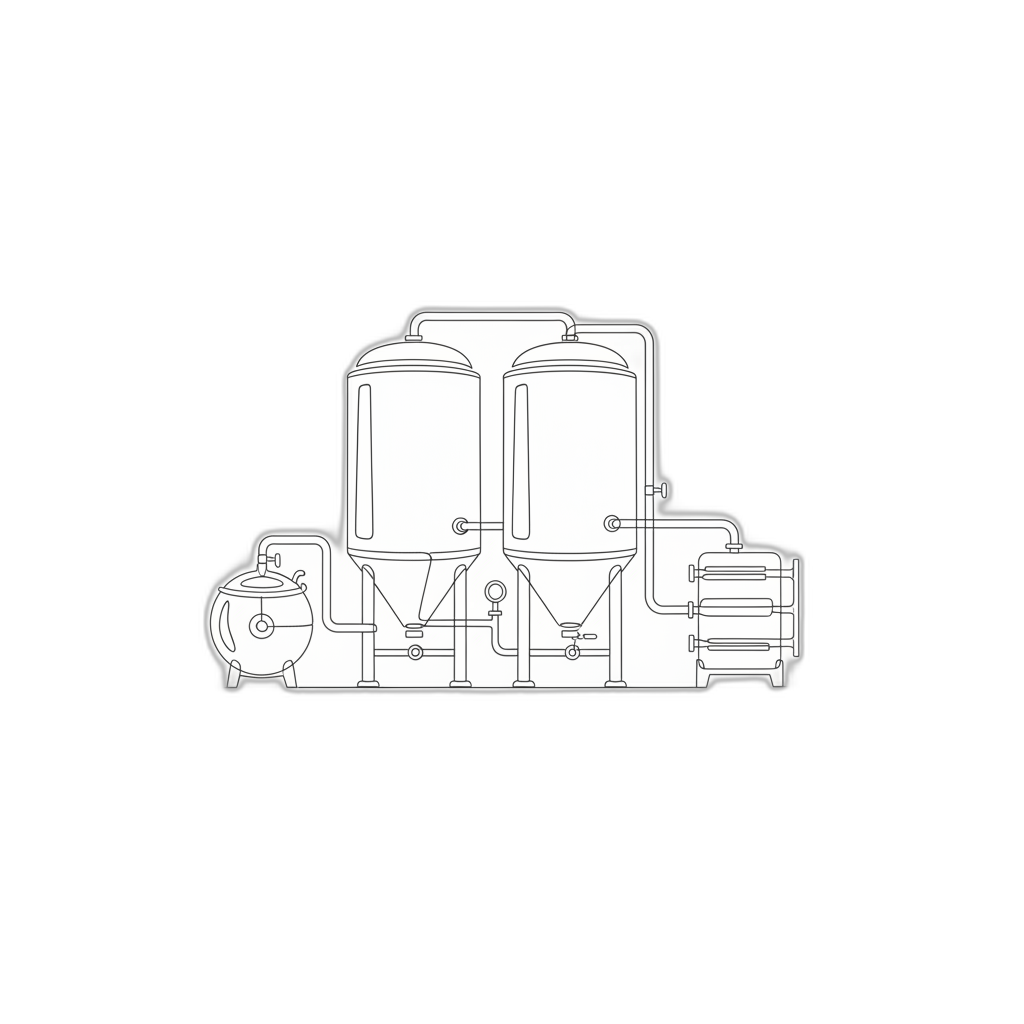

A beverage equipment appraisal represents a comprehensive professional evaluation of specialized machinery and systems used in beverage production, packaging, and service industries. This technical assessment provides critical insights into the precise market value of complex equipment utilized by breweries, wineries, coffee shops, bars, and beverage manufacturing facilities.

The valuation process involves a meticulous examination of diverse equipment types, ranging from intricate brewing systems and bottling lines to sophisticated dispensing mechanisms and quality control instruments. Professional appraisers conduct a thorough physical inspection, carefully assessing each asset's operational condition, maintenance history, technological specifications, and current market positioning.

Appraisers employ a multifaceted approach that integrates detailed on-site equipment evaluation with comprehensive market research. They analyze critical factors including equipment age, technological capabilities, brand reputation, original purchase value, and potential modifications or upgrades. This systematic methodology ensures an accurate and nuanced understanding of the equipment's true economic value.

The resulting appraisal provides stakeholders with a sophisticated financial snapshot, documenting equipment specifications, valuation methodology, current market trends, and a precise value estimate. Such detailed assessments support strategic decision-making for business owners, investors, financial institutions, and insurance providers by offering transparent, data-driven insights into asset valuation within the dynamic beverage industry landscape.

Can I get a Beverage Equipment appraisal done online?

Online beverage equipment appraisals have become increasingly sophisticated, offering professionals a comprehensive method to evaluate specialized machinery remotely. Through strategic digital assessment techniques, appraisers can effectively analyze equipment condition, technical specifications, and market value without requiring physical on-site inspections.

The process typically involves submitting detailed photographic evidence and comprehensive supplementary documentation via secure digital platforms. Professional appraisers utilize advanced technological tools to conduct thorough evaluations, ensuring precise and reliable assessments that meet rigorous industry standards.

Multiple engagement methods are available for clients seeking equipment valuation. These include asynchronous document submission, interactive video consultations, and real-time virtual equipment reviews using platforms like Zoom or Google Meet. Each approach allows appraisers to gather critical information and perform meticulous examinations comparable to traditional in-person assessments.

Key advantages of digital appraisal methodologies include enhanced accessibility, reduced logistical complications, accelerated turnaround times, and the ability to connect with specialized professionals regardless of geographical constraints. Modern appraisal techniques leverage advanced technological capabilities to deliver accurate, efficient, and professional evaluations tailored to unique equipment requirements.

By embracing digital assessment strategies, businesses can obtain comprehensive equipment valuations that maintain the highest standards of professional integrity and technical precision, all while minimizing time and resource investments traditionally associated with equipment appraisals.

What are the different types of Beverage Equipment appraisals?

Beverage equipment appraisers are specialized professionals who bring deep expertise to valuing machinery and equipment within the beverage industry. These professionals differ in their approach, focus, and specific areas of knowledge, offering tailored valuation services across various contexts.

General beverage equipment appraisers provide comprehensive assessments covering a wide range of production and service equipment. They possess broad knowledge about multiple equipment types, including kettles, fermentation tanks, bottling lines, and refrigeration units, enabling them to deliver well-rounded valuations based on comprehensive industry standards.

Specialized equipment appraisers concentrate on specific machinery categories, developing profound understanding of niche technologies. Their expertise might center on advanced water filtration systems, sophisticated carbonation equipment, or technical brewing machinery for specific beverage types like craft beer or artisan kombucha. These professionals deliver precise valuations by thoroughly understanding unique technological nuances and current market dynamics.

Operational appraisers take a holistic approach, evaluating equipment beyond its intrinsic value. They analyze operational efficiency, current condition, and potential business impact. By examining performance metrics and strategic potential, they help businesses understand the comprehensive economic value of their equipment investments.

Liquidation appraisers focus on determining fair market value during sales or asset disposition scenarios. They critically assess equipment's resale potential, considering current economic conditions and market demand. Their expertise is particularly valuable when businesses need to quickly and accurately value assets for potential sale.

Insurance appraisers specialize in establishing replacement values for insurance coverage. They work closely with insurance providers and beverage industry clients to ensure comprehensive protection, carefully evaluating replacement costs and potential depreciation for critical production equipment.

These diverse appraisal professionals collectively ensure that beverage industry equipment receives accurate, nuanced, and contextually appropriate valuation, supporting informed financial decision-making across different business scenarios.

Why should I get a Beverage Equipment appraisal?

Beverage equipment appraisals are critical strategic tools for businesses in the food and beverage industry, offering far-reaching financial and operational insights. These specialized valuations extend well beyond simple asset assessment, providing comprehensive insights that can significantly impact a company's financial strategy and risk management.

Tax compliance represents a key driver for equipment appraisals. When businesses donate equipment valued over $5,000, a professional appraisal becomes essential for substantiating tax deduction claims. By documenting fair market value precisely, organizations can maximize potential tax benefits while maintaining full regulatory compliance.

Legal proceedings frequently necessitate accurate equipment valuations. During complex scenarios like business dissolutions, partnership disputes, or succession planning, a detailed appraisal serves as an objective, authoritative reference point. This impartial documentation can expedite negotiations and reduce potential conflicts by providing clear, defensible asset values.

Insurance protection represents another crucial consideration. Comprehensive equipment appraisals enable businesses to secure appropriate coverage levels, ensuring adequate financial protection against potential losses from theft, damage, or catastrophic events. An accurate valuation guarantees that insurance settlements reflect true equipment value, preventing potential undercompensation.

Financial institutions and potential investors rely heavily on professional equipment appraisals when evaluating lending or investment opportunities. A meticulously documented valuation enhances a business's credibility, providing transparent insights into asset quality and potential return on investment. These assessments can directly influence financing terms and overall financial strategy.

By embracing professional beverage equipment appraisals, businesses transform a routine assessment into a strategic financial tool. These evaluations provide nuanced insights that support informed decision-making, risk management, and long-term operational planning.

How much does a Beverage Equipment appraisal cost?

Why Beverage Equipment Valuation Matters for Your Loan

When seeking financing for your beverage business, the valuation of your equipment is a critical element in the loan process. A comprehensive and accurate beverage equipment appraisal provides multiple strategic advantages for business owners and lenders alike.

Key Benefits of Equipment Valuation

- Strategic Loan Negotiation

Lenders use equipment appraisals as a fundamental metric to determine loan amounts. An accurate valuation establishes a credible financial foundation, enabling more precise funding discussions and preventing potential over or under-borrowing.

- Risk Mitigation for Lenders

Detailed equipment appraisals provide comprehensive insights into asset condition, market value, and potential resale opportunities. This transparency helps lenders assess and minimize potential financial risks associated with the loan.

- Collateral Optimization

Beverage equipment serves as a tangible asset for loan collateral. Precise valuations ensure fair representation of your assets, potentially improving loan terms and increasing lending confidence.

- Asset Depreciation Intelligence

Regular equipment appraisals track the evolving value of your assets, offering critical insights for financial planning, potential equipment replacement strategies, and long-term business budgeting.

- Comprehensive Financial Protection

Accurate valuations are essential for insurance coverage and regulatory compliance. They provide a documented basis for asset protection and help ensure adequate financial safeguards in case of unexpected events.

Strategic Considerations

Equipment valuation transcends simple accounting—it's a sophisticated financial strategy that supports business growth, secures favorable financing, and provides a clear perspective on your operational assets.

Key Equipment Categories Lenders Need to Understand

When appraising beverage equipment for loan collateral purposes, understanding the various equipment categories is crucial for lenders. Each category provides unique insights into the operational capacity, efficiency, and potential value of a beverage production or service business.

Brewing Equipment: The Production Foundation

Brewing equipment represents the core of beverage production, encompassing essential machinery for creating beverages like beer, coffee, and tea. Key components include:

- Brewhouses

- Fermentation tanks

- Bottling lines

- Mashing equipment

- Filtration systems

Dispensing Systems: Critical Service Infrastructure

These systems are vital for delivering beverages to consumers, including:

- Draft beer systems

- Soda fountains

- Juice dispensers

- Coffee brewing stations

- Beverage tap mechanisms

Packaging Equipment: Product Presentation and Efficiency

Packaging directly impacts product marketability and operational costs, featuring:

- Labeling machines

- Canning lines

- Bottling equipment

- Packaging material handling systems

- Sealing and wrapping machinery

Refrigeration Solutions: Preserving Product Quality

Temperature control is essential for maintaining beverage integrity, including:

- Commercial beverage coolers

- Walk-in refrigerators

- Ice machines

- Cold storage units

- Specialized temperature-controlled environments

Quality Control Instruments: Ensuring Product Standards

Precision instruments that guarantee product consistency and safety:

- pH meters

- Refractometers

- Turbidity meters

- Spectrophotometers

- Microbial testing equipment

By comprehensively evaluating these equipment categories, lenders can develop a more nuanced understanding of a beverage business's operational capacity, technological sophistication, and potential for future success.

Critical Factors Determining Your Equipment's Collateral Value

Key Determinants of Beverage Equipment Collateral Value

Accurately assessing the collateral value of beverage equipment requires a comprehensive evaluation of multiple critical factors. These elements not only influence loan potential but also provide crucial insights for strategic asset management.

1. Equipment Condition

- Physical state is a primary value driver

- Well-maintained equipment commands higher appraisal values

- Factors include:

- Operational efficiency

- Minimal wear and damage

- Overall functional integrity

2. Age and Technological Relevance

- Equipment age directly impacts residual value

- Newer models offer advantages such as:

- Advanced technological features

- Enhanced energy efficiency

- Improved performance capabilities

- Older equipment may experience value depreciation due to:

- Outdated technology

- Reduced operational efficiency

- Higher maintenance requirements

3. Market Demand and Industry Trends

- Equipment value fluctuates with industry dynamics

- Emerging trends can significantly impact valuation:

- Growing interest in craft beverage production

- Sustainable manufacturing practices

- Technological innovations

- Requires continuous market analysis and trend monitoring

4. Brand and Manufacturer Reputation

- Brand reputation substantially influences equipment value

- Key considerations include:

- Manufacturer reliability

- Product quality track record

- Industry recognition

- Established brands typically maintain higher resale and collateral values

5. Supply Chain and Parts Availability

- Parts accessibility impacts equipment valuation

- Critical factors include:

- Ease of obtaining replacement components

- Cost of maintenance and repairs

- Global supply chain stability

- Limited parts availability increases perceived risk for lenders

A holistic approach to evaluating these critical factors ensures a comprehensive and accurate assessment of beverage equipment's collateral value. By carefully analyzing condition, technological relevance, market trends, brand reputation, and supply chain dynamics, stakeholders can make informed decisions about equipment financing and asset management.

The Step-by-Step Appraisal Process for Beverage Industry Assets

The Comprehensive Appraisal Process for Beverage Industry Assets

Appraising beverage industry equipment requires a meticulous and strategic approach designed to provide accurate valuations for loan collateral purposes. The following step-by-step process ensures a thorough and reliable assessment of specialized beverage manufacturing assets.

Step 1: Define the Appraisal Purpose

- Clarify the specific objective of the valuation

- Align assessment with lender requirements

- Establish compliance with regulatory standards

- Determine the scope of the appraisal

Step 2: Comprehensive Asset Identification

Precise identification of assets is critical for an accurate valuation. This includes:

- Brewing machinery

- Bottling lines

- Storage tanks

- Refrigeration units

- Specialized processing equipment

- Auxiliary support systems

Step 3: Select Appropriate Valuation Methodology

Appraisers carefully evaluate three primary valuation approaches:

- Cost Approach: Assesses replacement or reproduction costs

- Income Approach: Evaluates potential revenue generation

- Market Approach: Compares similar asset sales and market conditions

Step 4: Comprehensive Data Collection

Gathering detailed information is crucial for an accurate assessment:

- Equipment specifications

- Precise age and manufacturing details

- Maintenance and service records

- Operational efficiency metrics

- Current market trends

- Technological relevance

Step 5: Detailed On-Site Inspection

A thorough physical examination provides critical insights:

- Verify documented equipment specifications

- Assess overall condition and wear

- Evaluate maintenance standards

- Inspect operational functionality

- Document current state of equipment

Step 6: Comprehensive Appraisal Reporting

The final stage involves creating a detailed, professional report that:

- Synthesizes collected data

- Presents clear valuation conclusions

- Meets lender documentation requirements

- Provides a credible basis for financial decision-making

By following this systematic approach, beverage industry stakeholders can obtain reliable asset valuations that support strategic financial planning and lending processes.

Ensuring Accuracy: Qualifications of a Professional Equipment Appraiser

When seeking a beverage equipment appraisal for loan collateral purposes, understanding the qualifications of professional equipment appraisers is crucial. The right appraiser brings a sophisticated blend of technical knowledge, industry expertise, and regulatory compliance.

Key Professional Certifications

Professional equipment appraisers are distinguished by their credentials from recognized appraisal organizations, which typically include:

- Rigorous training programs

- Comprehensive examinations

- Mandatory continuous education requirements

Recommended Certification Bodies

Look for appraisers certified by respected organizations such as:

- American Society of Appraisers (ASA)

- International Society of Appraisers (ISA)

Industry-Specific Expertise

Experience in the beverage equipment sector is paramount. A qualified appraiser should demonstrate:

- Hands-on knowledge of specific equipment types

- Understanding of commercial brewing systems

- Familiarity with specialized dispensing equipment

- Comprehensive insight into equipment functionality and market value

Methodological Rigor

Professional appraisers maintain high standards through:

- Adherence to Uniform Standards of Professional Appraisal Practice (USPAP)

- Comprehensive market analysis

- Detailed condition assessments

- Precise depreciation calculations

Essential Evaluation Criteria

When selecting an equipment appraiser, prioritize professionals who demonstrate:

- Recognized professional certifications

- Specialized industry experience

- Commitment to ethical standards

- Comprehensive analytical approaches

Choosing an appraiser with these qualifications ensures an accurate, reliable, and defensible valuation of beverage equipment for loan collateral purposes.

Strategic Valuation Methods That Protect Your Business Interests

In the competitive beverage industry, accurate equipment appraisal is crucial for determining the financial viability of your assets, especially when used as loan collateral. Strategic valuation methods protect your business interests by ensuring fair assessments and favorable loan terms.

Key Valuation Approaches for Beverage Equipment

1. Cost Approach

- Evaluates current replacement cost of equipment

- Subtracts depreciation to determine current value

- Most effective for new or specialized machinery

- Provides lenders with a clear understanding of tangible asset value

2. Market Approach

- Compares equipment to recently sold similar items

- Analyzes current market sales data

- Reflects real-time market trends and equipment values

- Particularly valuable in volatile market conditions

3. Income Approach

- Projects future cash flows generated by equipment

- Discounts projected earnings to present value

- Demonstrates equipment's revenue-generating potential

- Can potentially increase equipment valuation

Critical Valuation Considerations

Comprehensive Equipment Inspection

- Detailed assessment of equipment condition

- Evaluation of maintenance requirements

- Identification of specific features impacting value

- Ensures accuracy in valuation process

Importance of Specialized Expertise

- Utilize certified appraisers with beverage industry experience

- Ensures comprehensive and accurate valuation

- Provides compliance with lender requirements

- Protects overall business interests

By understanding and implementing these strategic valuation methods, businesses can secure more accurate equipment assessments, strengthen loan negotiations, and protect their critical assets.

Navigating Regulatory Requirements in Equipment Appraisal

Understanding Regulatory Compliance in Beverage Equipment Appraisal

Navigating the complex regulatory landscape of equipment appraisal requires a comprehensive approach, particularly when valuing beverage equipment for loan collateral purposes.

Key Regulatory Considerations

- Uniform Standards of Professional Appraisal Practice (USPAP)

- Establishes ethical and professional standards for appraisers

- Ensures credible and competent market value estimates

- Provides a consistent framework for valuation methodologies

- State and Local Regulatory Requirements

- Specific licensing laws for appraisers

- Certification and training mandates

- Documentation and reporting standards

Critical Factors in Beverage Equipment Appraisal

- Equipment Specificity

Different beverage equipment categories require specialized valuation approaches:

- Commercial brewing systems

- Bottling lines

- Refrigeration units

- Valuation Considerations

- Equipment age

- Current condition

- Technological advancements

- Operational context

Ensuring Comprehensive Appraisal Documentation

A robust appraisal report should encompass:

- Detailed valuation methodologies

- Explicit assumptions

- Comprehensive data sources

- Transparent analysis

Best Practices for Regulatory Compliance

To successfully navigate regulatory requirements, businesses should:

- Partner with qualified appraisers specializing in beverage equipment

- Maintain current knowledge of industry regulations

- Prioritize transparency and accuracy in valuation processes

- Continuously update appraisal methodologies

By carefully addressing these regulatory requirements, businesses can streamline the loan collateral process and minimize potential valuation disputes.

How Precise Appraisals Can Maximize Your Financing Potential

In the competitive world of business financing, accurate equipment appraisals are a critical strategic tool for beverage industry professionals. By obtaining precise valuations, businesses can unlock significant advantages that directly enhance their financial opportunities.

Key Benefits of Precise Equipment Appraisals

- Enhanced Lender Confidence: A comprehensive appraisal provides lenders with a clear, realistic assessment of equipment value, increasing the likelihood of favorable loan terms

- Risk Mitigation: Precise valuations prevent costly mistakes like overestimating or underestimating asset worth

- Financial Transparency: Detailed appraisals serve as critical documentation for audits and financial reporting

Strategic Valuation Considerations

Avoiding Valuation Pitfalls

Businesses must be cautious about two primary valuation risks:

- Overvaluation: Can lead to unrealistic loan requests and potential financial instability

- Undervaluation: May result in missed financing opportunities and reduced asset leverage

The Expertise Factor

Specialized appraisers bring critical advantages to the valuation process:

- Deep understanding of beverage equipment market trends

- Comprehensive evaluation of equipment condition and marketability

- Industry-specific benchmarking techniques

By leveraging precise appraisals, businesses can strategically position themselves for stronger financial opportunities, demonstrating professional asset management and creating a foundation for sustainable growth in a competitive market.

Real-World Insights: Successful Equipment Valuation Strategies

Navigating Successful Beverage Equipment Valuation Strategies

In the competitive landscape of beverage service, obtaining accurate equipment appraisals is critical for businesses seeking financial support through loans. Effective valuation strategies enhance the credibility of the appraisal process and ensure that equipment meets lender requirements.

Key Valuation Approaches

- Understanding Market Trends

- Analyze current depreciation rates for beverage equipment categories

- Track espresso machines, refrigerators, and bottle fillers

- Provide valuations reflecting current market conditions and future resale potential

- Comprehensive Condition Assessment

- Conduct thorough equipment examinations

- Evaluate operational efficiency

- Review maintenance records

- Identify modifications impacting equipment value

- Utilize standardized grading systems for consistent, objective assessments

- Comparative Market Analysis

- Examine recent sales data for similar beverage equipment

- Establish competitive and fair pricing benchmarks

- Provide context for equipment valuation

- Detailed Usage Evaluation

- Assess equipment usage intensity and patterns

- Consider wear and tear from high-volume settings

- Evaluate maintenance efforts

- Recognize impact of usage on overall equipment value

- Professional Expertise

- Engage specialized beverage equipment appraisers

- Leverage industry-specific knowledge

- Ensure compliance with industry standards

- Increase valuation reliability for lenders

By implementing these comprehensive strategies, businesses can develop equipment appraisals that are credible, detailed, and persuasive to potential lenders, ultimately improving their chances of securing favorable loan terms.

Your Questions Answered: Beverage Equipment Appraisal Essentials

When it comes to beverage equipment appraisal for loan collateral purposes, understanding the fundamentals is critical for business owners in the food and beverage industry. Accurate valuation of equipment serves as a crucial step in securing financing and protecting your business assets.

Understanding Beverage Equipment Appraisal

Beverage equipment appraisal is a comprehensive process that determines the fair market value of specialized machinery and tools used in beverage production and service. This valuation encompasses a wide range of equipment, including:

- Espresso machines

- Draft beer systems

- Brewing kettles

- Commercial refrigeration units

- Specialized beverage preparation equipment

Key Considerations for Equipment Valuation

Factors Impacting Equipment Value

Multiple critical factors influence the valuation of beverage equipment:

- Equipment Age and Condition

- Newer equipment typically retains higher value

- Well-maintained machines demonstrate longer operational potential

- Regular maintenance can preserve equipment value

- Brand and Model Reputation

- Premium brands often command higher resale values

- Equipment with proven reliability increases valuation

- Technology and innovation impact equipment worth

- Market Demand and Trends

- Industry-specific trends affect equipment valuation

- Emerging beverage markets can increase equipment value

- Specialized equipment for niche markets may have unique pricing

Importance for Loan Collateral

Lenders rely on professional equipment appraisals to:

- Assess potential loan risk

- Determine appropriate lending amounts

- Establish collateral value

- Potentially offer more favorable loan terms

Professional Appraisal Expertise

A credible equipment appraisal requires specialized professionals who:

- Understand food and beverage industry dynamics

- Possess technical knowledge of specialized equipment

- Can accurately assess current market conditions

- Provide comprehensive and reliable valuations

By thoroughly understanding these valuation principles, business owners can approach equipment appraisal with confidence, ensuring they maximize their financial opportunities and protect their valuable assets.

.avif)

.svg)