5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

The U.S. Small Business Administration collaborates with approved lenders to provide loan guarantees, which fundamentally transforms the lending landscape for small businesses. This approach allows financial institutions to extend credit to businesses that might not qualify for conventional loans, effectively lowering the risk for lenders while creating opportunities for entrepreneurs.

These loan programs offer remarkable flexibility, accommodating diverse business needs from startup capital to expansion funding. Businesses can access loan amounts ranging from modest sums to substantial investments, with repayment terms typically spanning 7 to 25 years. The competitive interest rates and extended repayment periods provide businesses with more manageable financial obligations compared to traditional lending options.

SBA loans come in multiple formats, each tailored to specific business requirements. The 7(a) Loan Program serves as the most versatile option, supporting working capital, equipment purchases, and real estate investments. Meanwhile, the 504 Loan Program focuses on fixed asset acquisitions, and the Microloan Program provides smaller funding amounts for emerging businesses with limited financial histories.

The fundamental appeal of SBA loans lies in their ability to democratize access to capital. By mitigating lending risks and offering more flexible qualification criteria, these programs empower entrepreneurs who might otherwise struggle to secure traditional financing. This approach not only supports individual businesses but also contributes to broader economic growth and innovation.

Ultimately, SBA loans represent more than just a financial product—they are a strategic tool for businesses navigating complex economic landscapes. Understanding their nuanced structure and potential can help entrepreneurs make informed decisions about their financial futures.

The appraisal process goes far beyond a simple price tag. It delivers a nuanced understanding of the property's worth by examining factors such as location, condition, comparable market sales, and potential income generation. Lenders rely on these professional assessments to determine loan eligibility, assess risk, and establish precise lending parameters.

For borrowers, an appraisal offers transparency and protection. It ensures they are making a sound financial investment by confirming the property's actual market value. The valuation helps prevent overpaying and provides a clear picture of the asset's potential.

Financial institutions use appraisals as a key risk management tool. By understanding the precise value of the collateral, they can make informed decisions about loan amounts, interest rates, and overall lending terms. This meticulous approach protects both the lender's investment and the borrower's financial interests.

The appraisal also plays a crucial role in meeting SBA regulatory requirements. It validates that the property meets specific guidelines, confirming its suitability as loan collateral. This compliance is essential for loan approval and helps streamline the application process.

Moreover, the appraisal serves multiple secondary functions. It supports insurance coverage calculations, assists in tax assessments, and provides a comprehensive documentation record for the loan application. This multifaceted utility makes the appraisal an indispensable component of the SBA loan process.

Ultimately, a professional property appraisal represents more than a mere formality. It is a strategic tool that brings clarity, mitigates financial risks, and facilitates informed decision-making for businesses seeking SBA loan financing.

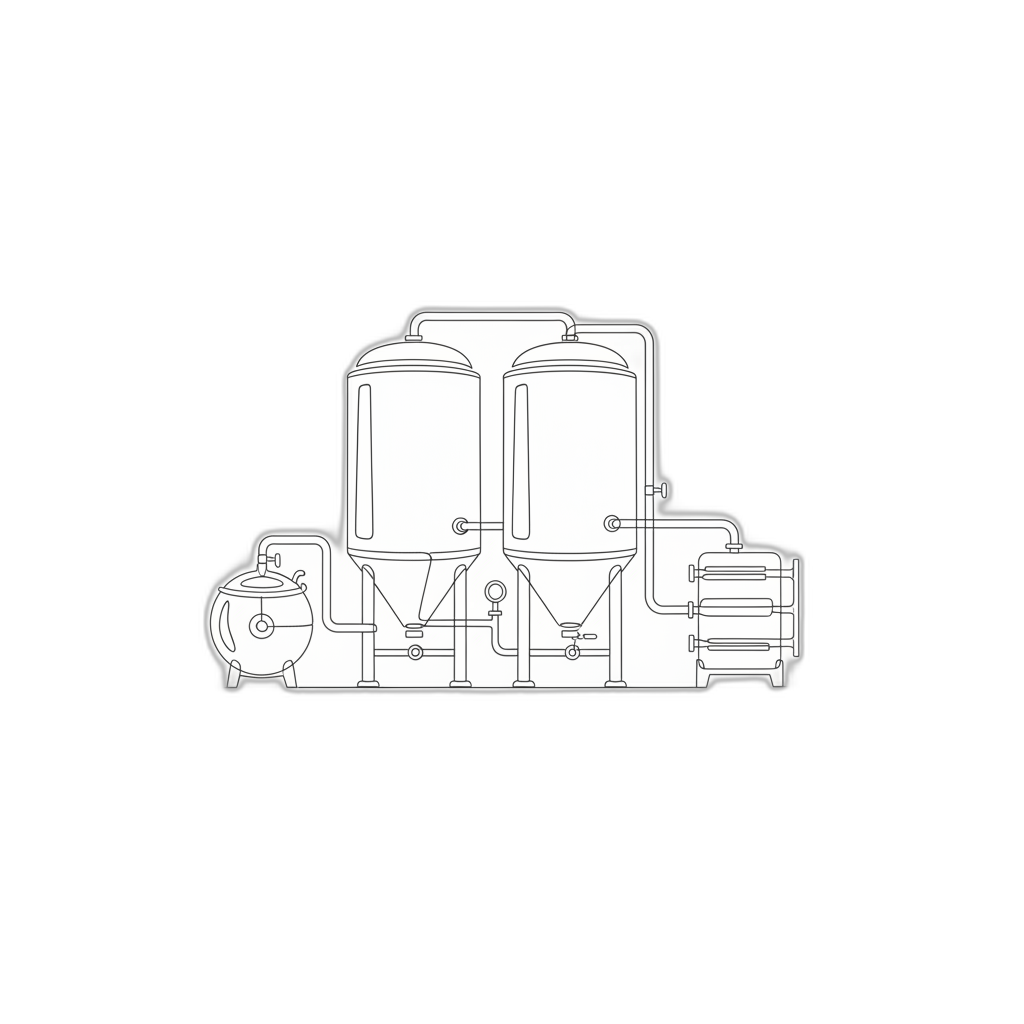

The valuation process involves a meticulous examination of diverse equipment types, ranging from intricate brewing systems and bottling lines to sophisticated dispensing mechanisms and quality control instruments. Professional appraisers conduct a thorough physical inspection, carefully assessing each asset's operational condition, maintenance history, technological specifications, and current market positioning.

Appraisers employ a multifaceted approach that integrates detailed on-site equipment evaluation with comprehensive market research. They analyze critical factors including equipment age, technological capabilities, brand reputation, original purchase value, and potential modifications or upgrades. This systematic methodology ensures an accurate and nuanced understanding of the equipment's true economic value.

The resulting appraisal provides stakeholders with a sophisticated financial snapshot, documenting equipment specifications, valuation methodology, current market trends, and a precise value estimate. Such detailed assessments support strategic decision-making for business owners, investors, financial institutions, and insurance providers by offering transparent, data-driven insights into asset valuation within the dynamic beverage industry landscape.

The process typically involves submitting detailed photographic evidence and comprehensive supplementary documentation via secure digital platforms. Professional appraisers utilize advanced technological tools to conduct thorough evaluations, ensuring precise and reliable assessments that meet rigorous industry standards.

Multiple engagement methods are available for clients seeking equipment valuation. These include asynchronous document submission, interactive video consultations, and real-time virtual equipment reviews using platforms like Zoom or Google Meet. Each approach allows appraisers to gather critical information and perform meticulous examinations comparable to traditional in-person assessments.

Key advantages of digital appraisal methodologies include enhanced accessibility, reduced logistical complications, accelerated turnaround times, and the ability to connect with specialized professionals regardless of geographical constraints. Modern appraisal techniques leverage advanced technological capabilities to deliver accurate, efficient, and professional evaluations tailored to unique equipment requirements.

By embracing digital assessment strategies, businesses can obtain comprehensive equipment valuations that maintain the highest standards of professional integrity and technical precision, all while minimizing time and resource investments traditionally associated with equipment appraisals.

General beverage equipment appraisers provide comprehensive assessments covering a wide range of production and service equipment. They possess broad knowledge about multiple equipment types, including kettles, fermentation tanks, bottling lines, and refrigeration units, enabling them to deliver well-rounded valuations based on comprehensive industry standards.

Specialized equipment appraisers concentrate on specific machinery categories, developing profound understanding of niche technologies. Their expertise might center on advanced water filtration systems, sophisticated carbonation equipment, or technical brewing machinery for specific beverage types like craft beer or artisan kombucha. These professionals deliver precise valuations by thoroughly understanding unique technological nuances and current market dynamics.

Operational appraisers take a holistic approach, evaluating equipment beyond its intrinsic value. They analyze operational efficiency, current condition, and potential business impact. By examining performance metrics and strategic potential, they help businesses understand the comprehensive economic value of their equipment investments.

Liquidation appraisers focus on determining fair market value during sales or asset disposition scenarios. They critically assess equipment's resale potential, considering current economic conditions and market demand. Their expertise is particularly valuable when businesses need to quickly and accurately value assets for potential sale.

Insurance appraisers specialize in establishing replacement values for insurance coverage. They work closely with insurance providers and beverage industry clients to ensure comprehensive protection, carefully evaluating replacement costs and potential depreciation for critical production equipment.

These diverse appraisal professionals collectively ensure that beverage industry equipment receives accurate, nuanced, and contextually appropriate valuation, supporting informed financial decision-making across different business scenarios.

Tax compliance represents a key driver for equipment appraisals. When businesses donate equipment valued over $5,000, a professional appraisal becomes essential for substantiating tax deduction claims. By documenting fair market value precisely, organizations can maximize potential tax benefits while maintaining full regulatory compliance.

Legal proceedings frequently necessitate accurate equipment valuations. During complex scenarios like business dissolutions, partnership disputes, or succession planning, a detailed appraisal serves as an objective, authoritative reference point. This impartial documentation can expedite negotiations and reduce potential conflicts by providing clear, defensible asset values.

Insurance protection represents another crucial consideration. Comprehensive equipment appraisals enable businesses to secure appropriate coverage levels, ensuring adequate financial protection against potential losses from theft, damage, or catastrophic events. An accurate valuation guarantees that insurance settlements reflect true equipment value, preventing potential undercompensation.

Financial institutions and potential investors rely heavily on professional equipment appraisals when evaluating lending or investment opportunities. A meticulously documented valuation enhances a business's credibility, providing transparent insights into asset quality and potential return on investment. These assessments can directly influence financing terms and overall financial strategy.

By embracing professional beverage equipment appraisals, businesses transform a routine assessment into a strategic financial tool. These evaluations provide nuanced insights that support informed decision-making, risk management, and long-term operational planning.

Why Are Beverage Equipment Appraisals Critical for SBA Lending?

Beverage equipment appraisals are essential in the Small Business Administration (SBA) lending process, serving multiple critical functions for both lenders and borrowers. Understanding their significance can establish a robust foundation for secure financing.

Key Functions of Beverage Equipment Appraisals

Fair Equipment Valuation

A comprehensive appraisal ensures accurate assessment of beverage equipment, which can include:

- Commercial blenders

- Specialized brewing systems

- Cold storage units

- High-end coffee machines

Professional appraisers evaluate equipment based on critical factors such as:

- Current market value

- Equipment functionality

- Age and condition

- Technological relevance

Lending Credibility

An independent, professional appraisal offers significant advantages in the SBA loan application process by:

- Providing an objective third-party assessment

- Demonstrating financial responsibility

- Offering transparent documentation

- Minimizing potential lending risks

Loan Processing Efficiency

Comprehensive equipment appraisals can substantially streamline the lending process by:

- Reducing documentation delays

- Preventing valuation disputes

- Presenting clear, professional evidence of equipment worth

- Accelerating overall loan approval timelines

Strategic Business Decision Making

Beyond lending requirements, equipment appraisals provide entrepreneurs with valuable insights for:

- Identifying optimal equipment upgrade opportunities

- Understanding current market equipment values

- Making informed investment decisions

- Aligning technological investments with business growth strategies

Ultimately, beverage equipment appraisals are a critical component of the SBA lending ecosystem, offering comprehensive benefits that support financial transparency, risk mitigation, and strategic business development.

Understanding the Nuances of Beverage Equipment Valuation

Understanding the Valuation Landscape for Beverage Equipment

Beverage equipment valuation is a sophisticated process that requires comprehensive analysis of multiple critical factors. Successful appraisals blend technical expertise with deep market understanding to provide accurate financial assessments.

Key Factors Influencing Equipment Value

- Equipment Condition and Age

- Physical state evaluation

- Assessment of wear and tear

- Review of maintenance history

- Operational functionality

- Equipment Type and Brand Considerations

- Impact of manufacturer reputation

- Market demand for specific equipment types

- Common equipment categories:

- Brewing systems

- Carbonation units

- Bottling lines

- Refrigeration systems

- Market Dynamics and Trends

- Industry shifts affecting equipment value

- Emerging beverage market trends

- Regional market variations

- Potential resale considerations

Specialized Valuation Considerations

Professional appraisers must navigate complex evaluation parameters, particularly when preparing documentation for financial purposes like SBA loans. This requires:

- Comprehensive technical assessment

- Thorough market research

- Adherence to specific lender guidelines

- Accurate representation of equipment's true economic value

Strategic Approach to Appraisal

Successful beverage equipment valuation demands a multifaceted approach that integrates technical knowledge, market intelligence, and financial acumen. By carefully analyzing equipment condition, brand reputation, market trends, and regional context, appraisers provide critical insights that support informed business decision-making.

What Factors Impact the Market Value of Your Brewing and Processing Assets?

Key Factors Impacting Brewing and Processing Equipment Valuation

Understanding the critical elements that influence your brewing and processing assets' market value is essential for accurate financial assessments and strategic decision-making.

1. Equipment Condition

- Physical state is a primary determinant of market value

- Appraisers comprehensively evaluate:

- Extent of wear and tear

- Overall equipment functionality

- Detailed maintenance history

- Well-maintained equipment consistently commands higher market values

2. Age and Technological Sophistication

- Equipment age directly impacts market valuation

- Technological capabilities significantly influence depreciation rates

- Potential considerations include:

- Efficiency of current technological features

- Compatibility with modern production standards

- Potential for technological upgrades

3. Brand Reputation and Market Perception

- Manufacturer's reputation plays a crucial role in equipment valuation

- Factors influencing brand value include:

- Historical performance reliability

- Industry recognition

- Customer satisfaction ratings

- Established brands typically retain higher resale values

4. Current Market Dynamics

- Market demand fluctuates based on multiple economic factors

- Key market influence elements:

- Industry growth trends

- Current economic conditions

- Regional and national manufacturing landscapes

5. Regulatory Compliance and Standards

- Equipment meeting current industry standards commands premium valuations

- Critical compliance considerations include:

- Safety regulations

- Operational standards

- Environmental requirements

- Compliant equipment presents lower risk for potential buyers

By understanding these pivotal factors, businesses can strategically manage their brewing and processing assets, ensuring optimal valuation and financial positioning.

The Comprehensive Appraisal Process for Beverage Industry Equipment

The Comprehensive Appraisal Process for Beverage Industry Equipment

Appraising beverage equipment demands a sophisticated approach that integrates industry expertise, technical knowledge, and financial acumen. For businesses seeking SBA loan financing, a meticulous valuation process is critical to accurately representing equipment value.

Key Stages of Beverage Equipment Appraisal

- Initial Consultation

- Gather comprehensive information about the business and equipment

- Collect details including:

- Beverage production type

- Production capacity

- Equipment age

- Significant modifications

- Establish a foundation for accurate assessment

- Research and Analysis

- Conduct in-depth market trend evaluation

- Analyze:

- Comparable equipment sales

- Current economic conditions

- Industry-specific reports

- Develop a comprehensive baseline for equipment valuation

- Physical Inspection

- Perform detailed on-site equipment assessment

- Evaluate critical factors:

- Equipment condition

- Operational functionality

- Maintenance history

- Identify potential value impacts

- Valuation Methodologies

- Implement multiple valuation approaches:

- Cost Approach: Replacement equipment value

- Income Approach: Potential revenue generation

- Sales Comparison Approach: Market-based equipment values

- Select most appropriate methodology based on specific circumstances

- Implement multiple valuation approaches:

- Comprehensive Final Report

- Develop detailed documentation including:

- Appraisal findings

- Valuation methodologies

- Final equipment value determination

- Provide essential information for financial decision-making

- Develop detailed documentation including:

A strategic and thorough appraisal process enables beverage industry stakeholders to confidently understand their equipment's true market value and support critical financial objectives.

Choosing the Right Appraiser: Expertise Matters

Selecting the Right Appraiser for Beverage Equipment Valuation

Choosing the right appraiser for your beverage equipment valuation is a critical step in securing SBA loan financing. The appraisal process goes far beyond a simple assessment – it's a strategic approach that provides lenders with confidence in your business's collateral.

Key Considerations for Appraiser Selection

- Industry-Specific Expertise

An exceptional appraiser brings deep understanding of beverage equipment nuances. This includes comprehensive knowledge of:

- Brewing machinery valuation

- Bottling line assessments

- Refrigeration unit evaluations

- Equipment age and condition analysis

- Current market demand trends

- Professional Credentials

Validate the appraiser's professional standing by examining:

- Industry-recognized certifications

- Membership in professional appraisal associations

- Ongoing professional education participation

- Adherence to ethical standards and practices

- Proven Performance Track Record

Look for tangible evidence of successful past performance, including:

- Client references from beverage industry businesses

- Detailed case studies or portfolio examples

- Positive client testimonials

- Consistent, reliable valuation history

- Communication Expertise

An outstanding appraiser should demonstrate:

- Clear, concise report writing

- Ability to explain complex valuation methodologies

- Comprehensive documentation

- Responsiveness to lender and client inquiries

The Impact of a Strategic Appraisal Selection

Your choice of appraiser directly influences the effectiveness of your equipment valuation. A meticulous, knowledgeable professional can provide the detailed insights necessary to navigate the SBA loan application process successfully.

By carefully evaluating potential appraisers across these critical dimensions, you significantly enhance your chances of securing the financing needed to grow and sustain your beverage equipment business.

Regulatory Landscape: SBA Loan Appraisal Requirements

Securing financing through Small Business Administration (SBA) loans requires a comprehensive understanding of the regulatory landscape surrounding beverage equipment appraisals. The SBA has established specific guidelines to ensure thorough and accurate asset valuations that protect both lenders and borrowers.

Key Regulatory Requirements

- Compliance with Uniform Standards of Professional Appraisal Practice (USPAP)

- Detailed assessment of equipment's current market value

- Comprehensive evaluation of equipment condition and market relevance

Critical Appraisal Considerations

Beverage equipment appraisals involve a meticulous examination of multiple factors that impact the asset's value:

- Equipment Condition

- Age and Technological Relevance

- Brand and Model Specifications

- Current Market Demand

- Industry-Specific Technological Advancements

Importance of Accurate Valuation

For lenders, a precise equipment appraisal serves several crucial purposes:

- Assessing the true financial risk of the loan

- Verifying the reliability of proposed collateral

- Ensuring the equipment can support the business's operational needs

Professional Appraisal Standards

Qualified appraisers must demonstrate:

- Relevant professional credentials

- Adherence to ethical appraisal practices

- In-depth understanding of beverage industry equipment

- Ability to provide objective, market-driven valuations

Navigating the SBA loan process requires a strategic approach to equipment valuation. Business owners who invest in comprehensive, professional appraisals position themselves more favorably when seeking financial support, ultimately creating a solid foundation for business growth and success.

Maximizing Your Equipment's Appraised Value: Strategic Preparation

Understand Equipment Condition

A comprehensive assessment of your beverage equipment's condition is the foundation of maximizing its appraised value. Key considerations include:

- Thorough examination of current operational status

- Detailed documentation of wear and tear

- Comprehensive maintenance history

- Overall equipment efficiency and performance

Well-maintained equipment not only demonstrates responsible ownership but directly impacts valuation. Addressing minor repairs and ensuring pristine presentation can significantly influence the appraiser's perception.

Document Comprehensive Equipment Information

Meticulously compiled documentation serves as critical evidence of your equipment's value. Essential documentation includes:

- Original purchase invoices and receipts

- Complete maintenance and service records

- Detailed logs of upgrades and improvements

- High-quality photographs capturing equipment from multiple angles

- Manufacturer specifications and original equipment manuals

Thorough documentation provides appraisers with a holistic view of the equipment's history, potential, and current market value.

Conduct Comprehensive Market Research

Understanding current market dynamics is crucial for accurate equipment valuation. Strategic research steps include:

- Analyzing comparable equipment sales in your industry

- Monitoring online marketplaces and auction platforms

- Reviewing industry-specific equipment valuation reports

- Tracking technological advancements in beverage equipment

Current market insights help position your equipment competitively and support its appraised value.

Select a Specialized Appraiser

Choosing the right appraiser can make a significant difference in your equipment's valuation. Consider the following selection criteria:

- Proven expertise in beverage equipment appraisals

- Experience with SBA loan assessment processes

- Industry-specific knowledge and credentials

- Track record of thorough and unbiased evaluations

A qualified appraiser brings nuanced understanding that translates into more accurate equipment valuation.

Optimize Appraisal Preparation

Proactive preparation can streamline the appraisal process and potentially enhance your equipment's perceived value:

- Create a detailed equipment inventory

- Organize all relevant documentation

- Prepare for a comprehensive walkthrough

- Demonstrate transparency and cooperation

- Be ready to provide additional context about equipment usage and maintenance

Strategic preparation demonstrates professionalism and can positively influence the appraisal outcome.

Final Considerations

Successful equipment appraisal requires a multifaceted approach combining meticulous documentation, market awareness, and strategic presentation. By implementing these comprehensive strategies, you maximize the potential of securing an accurate and favorable equipment valuation.

Depreciation Dynamics: How Age and Condition Affect Equipment Valuation

Understanding Depreciation in Beverage Equipment Valuation

Depreciation plays a critical role in determining the value of beverage equipment, especially for businesses pursuing SBA loans. This complex process involves multiple key factors that influence an asset's overall market value.

Key Factors Impacting Equipment Valuation

- Equipment Age

- Older equipment typically experiences reduced market value

- Technological advancements can rapidly diminish equipment worth

- Non-compliance with current food safety standards can significantly lower appraisal value

- Condition Assessment

- Well-maintained equipment commands higher valuation

- Factors considered include:

- Mechanical performance

- Structural integrity

- Quality of previous repairs

- Functional upgrades

- Regular servicing directly impacts equipment longevity and resale potential

- Market Demand Dynamics

- Current market trends significantly influence equipment value

- High-demand equipment models retain value more effectively

- Appraisers analyze recent sales of comparable equipment

- Economic Environment Considerations

- Economic conditions impact equipment valuation

- Downturns can lead to extended equipment usage

- Delayed upgrades can affect overall equipment condition and value

Comprehensive Valuation Strategy

Professional appraisers integrate these multifaceted considerations to generate accurate equipment valuations. By meticulously examining age, condition, market trends, and economic factors, they provide comprehensive assessments that support informed business decision-making.

Understanding these depreciation dynamics empowers business owners to strategically manage and evaluate their equipment investments, particularly when pursuing financing opportunities.

Real-World Success: Beverage Equipment Appraisal Case Studies

Beverage equipment appraisal has proven critical for businesses seeking SBA loans, delivering precise valuations that facilitate financing and support strategic growth. Real-world case studies demonstrate the transformative power of professional equipment appraisals.

Case Study: Craft Brewery Expansion

A craft brewery seeking to expand production faced significant financing challenges. By engaging a professional appraiser, they achieved remarkable results:

- Comprehensive equipment assessment conducted

- Detailed evaluation of existing brewing tanks and specialized equipment

- Documented current market value and condition

- Secured necessary SBA loan funding

- Negotiated more favorable loan terms

Case Study: Coffee Roasting Company Growth

A coffee roasting business aiming to diversify its product line encountered initial financing obstacles. A strategic equipment appraisal provided crucial insights:

- Thorough analysis of current and potential equipment assets

- Evaluation of market trends and equipment demand

- Detailed assessment of depreciation factors

- Successful SBA loan acquisition

- Accelerated expansion strategy

Strategic Benefits of Equipment Appraisal

These case studies underscore the profound impact of professional equipment appraisals beyond loan acquisition:

- Provides accurate asset valuation

- Supports informed investment decisions

- Enhances financial credibility

- Identifies potential growth opportunities

- Enables more strategic business planning

Professional equipment appraisals are more than a procedural requirement—they are a strategic tool that empowers businesses to unlock their full potential in an increasingly competitive marketplace.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)