5-Star Service, Trusted & Loved by Hundreds

Your Appraiser Search Ends Here

Your Appraiser Search Ends Here

.avif)

Nationwide Coverage – Appraisals Anywhere in the US

Get it done Onsite or Online

Any Asset, Covered

Defensible for Any Purpose

Frequently Asked

Questions

No Frequently Asked Questions Found.

The concept operates on a straightforward principle: if a borrower fails to repay the loan according to agreed terms, the lender retains the legal right to seize and liquidate the pledged asset to recover their financial losses. These assets can range widely, including real estate properties, vehicles, cash accounts, business inventory, equipment, and investment portfolios.

For borrowers, utilizing collateral can yield significant advantages. Secured loans typically feature more attractive terms, such as reduced interest rates and potentially higher borrowing limits. Individuals with limited credit history or lower credit scores may find collateral particularly beneficial, as it increases their likelihood of loan approval by providing lenders with additional confidence.

However, borrowers must carefully evaluate their financial capabilities before pledging assets. The potential consequences of defaulting—losing a valuable asset like a home or vehicle—underscore the importance of thorough financial planning and realistic repayment assessments.

Lenders view collateral as a critical risk management tool, enabling them to extend credit more confidently and under more favorable conditions. By having a tangible asset backing the loan, financial institutions can mitigate potential monetary losses and create a more structured lending environment.

The dynamics of loan collateral reflect a nuanced balance between borrower needs and lender protections, representing a sophisticated approach to managing financial risk in lending transactions.

The primary purpose of a collateral appraisal is to establish a precise and unbiased assessment of an asset's worth. This professional valuation ensures lenders can accurately gauge the potential risk associated with extending credit. By determining the true market value, financial institutions can make informed decisions about loan amounts, terms, and potential recovery strategies in case of default.

For borrowers, an appraisal offers transparency and credibility in the lending process. It provides documented evidence of an asset's value, which can potentially strengthen negotiation positions and lead to more favorable loan terms. The appraisal serves as an independent verification that protects both parties' interests by establishing a clear, professional understanding of the asset's economic standing.

Beyond immediate lending considerations, an appraisal also captures broader market insights. Professional appraisers analyze current market trends, potential asset depreciation, and comparative values, which can offer valuable context about the collateral's long-term financial implications.

Regulatory compliance represents another critical aspect of collateral appraisals. Financial institutions must adhere to strict guidelines that mandate thorough due diligence in credit extension. A comprehensive appraisal helps satisfy these requirements, mitigating potential legal and financial risks for all involved parties.

Ultimately, a professional appraisal transforms a potentially subjective asset valuation into an objective, defensible assessment. It provides a foundation of trust, accuracy, and informed decision-making in the complex landscape of loan collateralization.

The process involves a systematic approach that considers multiple critical factors. Appraisers carefully evaluate each piece of equipment, examining its technological specifications, current market conditions, physical condition, and potential functional utility. They analyze the equipment's age, technological relevance, operational status, and overall performance capabilities to generate an accurate valuation.

Key considerations during the appraisal include detailed documentation of the equipment's make, model, serial number, and maintenance history. Appraisers conduct thorough market research to understand current demand, technological trends, and comparable sales in the scientific equipment marketplace. They assess the equipment's condition through rigorous inspection, determining its operational integrity and potential remaining useful life.

Multiple valuation methodologies may be employed, including cost approach, sales comparison, and income-based strategies. These techniques allow for a comprehensive assessment that considers replacement costs, current market values, and potential revenue generation capabilities.

Professional lab equipment appraisals serve critical functions across various sectors, including research institutions, pharmaceutical companies, educational facilities, and biotechnology organizations. They provide essential insights for financial reporting, strategic planning, insurance documentation, and potential transaction considerations.

The true value of a professional appraisal lies not just in generating a number, but in offering a comprehensive understanding of scientific assets that supports informed decision-making and strategic asset management.

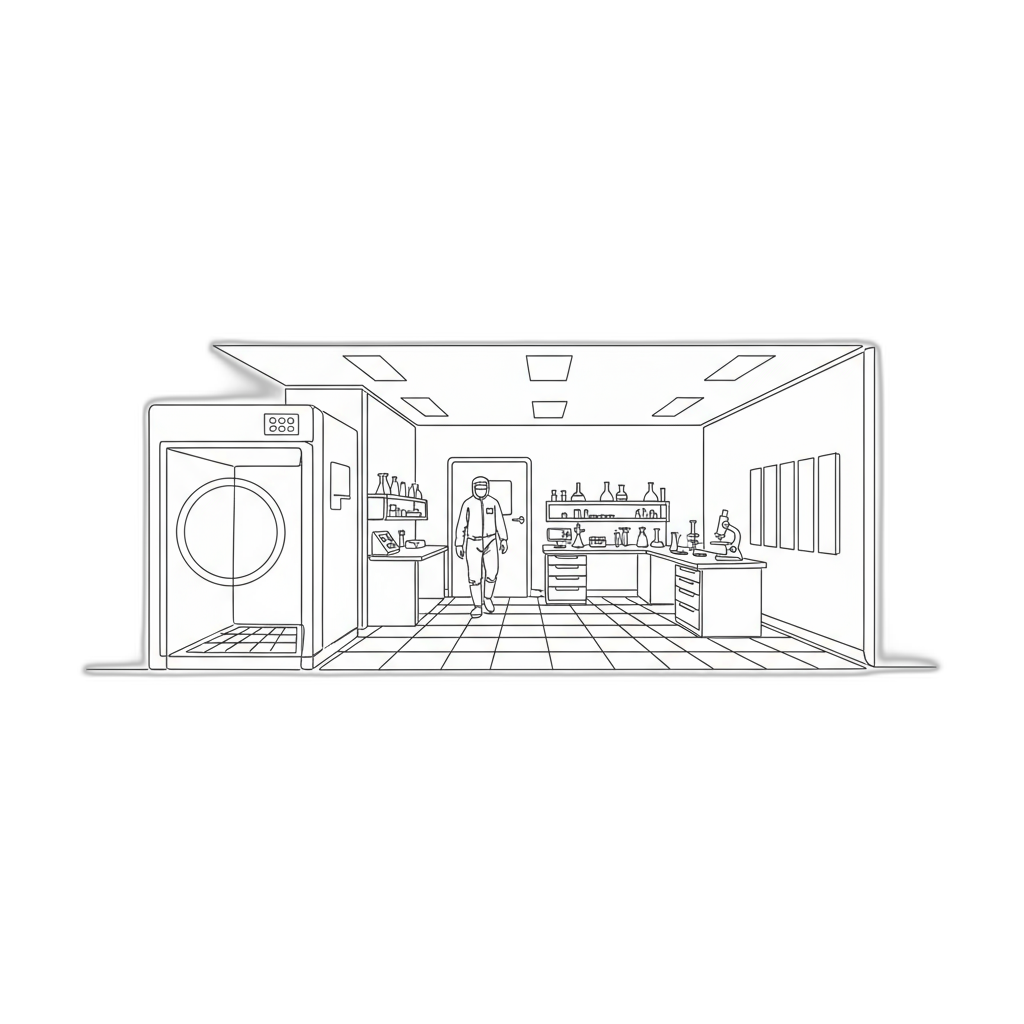

Appraisers can now collect detailed information through multiple digital channels, including high-resolution photographs, comprehensive documentation, and interactive video consultations. This approach is particularly advantageous for stationary or complex equipment that may be challenging to relocate or physically inspect.

Advanced digital methods allow professionals to thoroughly examine equipment specifications, condition, age, and market value with remarkable precision. Live video conferencing platforms enable real-time interactions, where appraisers can conduct detailed visual assessments and ask targeted questions about the equipment's history and functionality.

The digital appraisal process offers significant benefits for laboratories, research institutions, and businesses with equipment distributed across multiple locations. By minimizing logistical constraints, these online approaches provide flexibility, reduce assessment time, and maintain the highest standards of professional evaluation.

Qualified appraisers utilize sophisticated techniques to ensure accurate valuations that reflect current market conditions, technological relevance, and specific equipment characteristics. Their expertise guarantees a comprehensive and reliable assessment that meets professional industry standards.

General lab equipment appraisers maintain broad competencies, capable of evaluating diverse instruments ranging from basic microscopes to sophisticated analytical equipment. Their comprehensive understanding allows them to provide holistic assessments that consider technological complexity, market demand, and current operational condition.

Specialized appraisers delve into specific scientific domains, developing nuanced expertise in particular equipment categories. Medical diagnostics, biotechnology, pharmaceutical research, and industrial quality control represent key areas where these professionals demonstrate exceptional technical acumen. Their targeted knowledge enables precise valuations that account for intricate technological specifications and industry-specific performance standards.

Industrial and regulatory-focused appraisers bring additional layers of complexity to equipment assessment. They integrate deep understanding of compliance requirements, safety standards, and operational protocols into their valuation methodologies. For organizations operating in highly regulated environments, these professionals provide critical insights that extend beyond monetary value.

Forensic equipment appraisers occupy a unique niche, understanding the specialized requirements of investigative laboratories. Their assessments consider not just monetary value, but also critical factors like evidentiary integrity, precision instrumentation, and specialized technological capabilities.

Each appraiser type contributes distinctive perspectives, ensuring comprehensive and accurate equipment valuations that support strategic decision-making across scientific and industrial sectors.

Financial clarity stands as a primary benefit of professional equipment assessment. Precise valuations enable accurate financial reporting, support tax compliance, and provide critical documentation for insurance purposes. Organizations can optimize their asset management strategies by understanding the true market value and depreciation trajectory of their scientific instrumentation.

Equipment appraisals become particularly crucial during significant business transitions such as mergers, acquisitions, or strategic equipment sales. They offer an objective, professionally validated perspective on asset worth, facilitating transparent negotiations and informed decision-making. For research institutions and corporate laboratories, this means maintaining financial integrity while supporting strategic planning.

Insurance and risk management represent another vital consideration. Accurate equipment valuations ensure appropriate coverage levels, protecting organizations from potential underinsurance or unnecessary premium expenditures. In scenarios of loss or damage, a credible appraisal expedites claims processes and supports fair compensation.

Legal scenarios also benefit significantly from professional equipment assessments. Whether addressing estate planning, partnership dissolutions, or asset divisions, a meticulously documented appraisal provides an impartial benchmark for determining equipment value.

Beyond immediate financial implications, equipment appraisals offer strategic insights into technological infrastructure. They help organizations understand depreciation patterns, plan capital expenditures, and make informed decisions about equipment upgrades or replacements.

Ultimately, a comprehensive lab equipment appraisal transcends simple monetary evaluation. It represents a strategic tool that empowers organizations to make data-driven decisions, maintain financial transparency, and optimize their technological investments.

Why Lab Equipment Appraisals Matter for Securing Financing

Lab equipment appraisals play a critical role in securing financing for research institutions, medical facilities, and scientific organizations. These comprehensive valuations are essential for both borrowers and lenders to understand the true economic value of specialized laboratory assets.

Key Components of Lab Equipment Appraisals

- Comprehensive Asset Assessment: Provides a detailed analysis of equipment's current market value, condition, and potential depreciation

- Financial Risk Mitigation: Ensures accurate collateral valuation for loan agreements

- Transparent Valuation Process: Offers clear documentation of equipment's worth

Critical Valuation Considerations

Technical Complexity

Laboratory equipment often represents sophisticated technology with nuanced valuation requirements. Specialized appraisals consider:

- Current technological capabilities

- Remaining useful life

- Replacement cost

- Market demand for specific instrument types

Financial Impact

Accurate appraisals directly influence financing outcomes by:

- Determining precise loan-to-value ratios

- Establishing fair collateral value

- Reducing potential disputes between lenders and borrowers

Strategic Benefits

Beyond immediate financing needs, equipment appraisals provide strategic insights into an organization's technological infrastructure and potential future investment requirements. They serve as a critical tool for financial planning, asset management, and long-term scientific investment strategies.

By delivering a precise, comprehensive evaluation, lab equipment appraisals transform complex technological assets into clear, quantifiable financial resources that can support organizational growth and innovation.

The Critical Role of Accurate Equipment Valuation

Accurate equipment valuation is fundamental in the complex landscape of lab equipment appraisal, particularly when securing loans. Financial institutions rely heavily on precise and reliable valuations to mitigate lending risks, making it crucial for borrowers to comprehend the nuanced process of assessing equipment value.

Understanding Lab Equipment Valuation Complexity

Lab equipment encompasses a diverse range of sophisticated instruments, including:

- Analytical instruments

- Diagnostic machines

- Specialized scientific tools

Each piece of equipment represents a unique valuation challenge, with value determined by multiple interconnected factors such as:

- Chronological age

- Current physical condition

- Technological relevance

- Current market demand

Key Benefits of Comprehensive Equipment Valuation

Risk Management for Financial Institutions

A meticulous valuation provides lenders with transparent insights into collateral worth, strategically reducing potential loan default risks. By establishing precise equipment value, financial institutions can make informed lending decisions with enhanced confidence.

Strategic Asset Assessment

Comprehensive valuations offer critical advantages across multiple operational dimensions:

- Depreciation Tracking: Evaluates equipment value considering technological obsolescence and wear

- Insurance Protection: Ensures adequate coverage for specialized scientific assets

- Asset Management: Facilitates strategic planning for equipment upgrades and replacements

- Regulatory Compliance: Maintains accurate financial documentation and prevents potential legal complications

Professional Valuation: A Strategic Investment

Engaging a qualified appraiser with specialized knowledge in scientific equipment valuation transcends basic financial assessment. Such expertise provides nuanced insights that support critical financial decision-making, benefiting both borrowers and lenders in the complex ecosystem of laboratory asset management.

What Types of Laboratory Equipment Hold the Most Collateral Value?

Key Laboratory Equipment Categories with High Collateral Value

When assessing laboratory equipment for collateral purposes, certain equipment categories demonstrate significantly higher market value and resale potential. Understanding these categories helps lenders and borrowers accurately evaluate equipment worth.

Top Equipment Categories for Collateral Valuation

- Analytical Instruments

High-precision equipment critical for research and quality control, including:

- Mass spectrometers

- Chromatographs

- Spectrophotometers

- Biological Safety Cabinets

Essential safety equipment with consistent market demand, valued for:

- User protection

- Specimen preservation

- Compliance with safety standards

- Centrifuges

Versatile equipment with significant value, particularly advanced models featuring:

- High RPM capabilities

- Large processing capacity

- Multi-field applications

- Heating and Cooling Equipment

Precision temperature control devices that retain substantial value, such as:

- Incubators

- Laboratory ovens

- Environmental chambers

- Imaging Systems

Advanced technological equipment with high market demand, including:

- Electron microscopes

- Digital imaging systems

- Specialized research visualization tools

- General Laboratory Equipment

Supplementary items that contribute to overall valuation when well-maintained:

- Precision glassware

- Analytical balances

- Calibrated pipettes

Factors Influencing Collateral Value

Equipment collateral value is determined by multiple interconnected factors:

- Overall equipment condition

- Technological sophistication

- Market demand

- Maintenance history

- Potential for continued research application

A comprehensive appraisal considers these nuanced elements to provide an accurate assessment of laboratory equipment's true market value.

Key Determinants of Lab Equipment's Financial Worth

Key Factors Influencing Lab Equipment Valuation

When assessing the financial worth of lab equipment for loan collateral purposes, several critical factors play a significant role in determining its overall value. Understanding these determinants enables stakeholders to make informed decisions and optimize their financial strategies.

1. Equipment Age and Physical Condition

- Newer models typically command higher prices due to advanced technology and improved efficiency

- Well-maintained equipment retains more value compared to units showing significant wear

- Physical condition directly impacts the equipment's marketability and potential resale value

2. Market Pricing and Historical Cost

- Original purchase price provides an initial valuation baseline

- Current market trends and comparable sales are crucial in determining actual value

- Depreciation rates vary significantly across different types of laboratory equipment

3. Technological Relevance

- Equipment incorporating cutting-edge technological advancements typically experiences higher valuation

- Operational efficiency and accuracy are key drivers of equipment value

- Reduced downtime and enhanced performance capabilities increase financial worth

4. Brand Reputation and Manufacturing Quality

- Established manufacturers with strong reputations for quality and reliability

- Equipment from recognized brands often maintains higher resale and collateral value

- Proven track record of performance influences potential buyers and appraisers

5. Market Demand and Equipment Specificity

- Availability and demand for specific equipment types fluctuate over time

- Rare or specialized equipment can command premium pricing

- Highly abundant equipment may experience reduced valuation

6. Regulatory Compliance and Certification

- Equipment meeting industry-specific regulatory standards holds higher value

- Certifications demonstrate reliability and safety in professional environments

- Compliance documentation can significantly enhance equipment's financial worth

By comprehensively evaluating these determinants, stakeholders can develop a nuanced understanding of their lab equipment's financial potential, enabling more strategic decision-making in loan collateral assessments.

Navigating the Lab Equipment Appraisal Process

Understanding the Lab Equipment Appraisal Process

Navigating a lab equipment appraisal requires strategic planning and careful attention to detail to secure optimal loan collateral and financial assessment.

Key Steps in Lab Equipment Appraisal

- Select a Qualified Appraiser

- Choose an expert with specialized knowledge in laboratory equipment

- Verify professional credentials and industry experience

- Ensure understanding of complex scientific and technological equipment

- Comprehensive Equipment Inventory

- Document detailed equipment specifications

- Include critical information such as:

- Make and model

- Manufacturing year

- Current condition

- Significant modifications or upgrades

- Create a systematic and organized record

- Physical Equipment Inspection

- Conduct thorough on-site evaluation

- Assess functional capabilities

- Identify potential value-impacting issues

- Verify operational status and performance

- Market Trend Analysis

- Evaluate current technological landscape

- Consider sector-specific demand

- Analyze equipment depreciation rates

- Review emerging technological innovations

- Detailed Valuation Reporting

- Receive comprehensive appraisal documentation

- Understand valuation methodology

- Use report for financial planning

- Leverage insights for strategic decision-making

Critical Considerations

A successful lab equipment appraisal requires a holistic approach that balances technical expertise, market understanding, and precise documentation. By following a structured process, organizations can effectively demonstrate equipment value and secure appropriate financial support.

Diligent preparation and collaboration with experienced professionals ensure accurate valuations that reflect true equipment worth and potential.

Selecting the Right Appraiser: What You Need to Know

Critical Considerations for Selecting the Right Appraiser

Choosing an appraiser for lab equipment valuation requires careful evaluation to ensure accurate and credible assessment for loan collateral purposes. The right professional can significantly impact your financing outcomes.

Key Selection Criteria

- Specialized Experience

Look for appraisers with deep expertise specifically in laboratory equipment valuation. This specialized knowledge ensures precise understanding of complex scientific instrumentation's true market value.

- Professional Credentials

Verify the appraiser's qualifications through recognized professional organizations. Credentials demonstrate:

- Rigorous training

- Adherence to industry standards

- Commitment to ongoing professional development

- Technical Valuation Expertise

A qualified appraiser must demonstrate comprehensive understanding of multiple valuation methodologies, including:

- Fair Market Value (FMV)

- Orderly Liquidation Value (OLV)

- Forced Liquidation Value (FLV)

Essential Evaluation Process

- Comprehensive Inspection

The appraiser should conduct thorough on-site equipment assessment, examining:

- Equipment condition

- Technological relevance

- Operational functionality

- Detailed Reporting

Expect a transparent, comprehensive report that clearly articulates:

- Valuation methodology

- Specific assessment criteria

- Market comparisons

- Detailed justification for assigned value

Additional Verification Steps

- Client References

Request and thoroughly check previous client testimonials and references to validate:

- Professional reputation

- Service quality

- Reliability

- Industry Network Validation

Consider professional recommendations from industry associations or scientific equipment networks to further validate the appraiser's credibility.

By meticulously evaluating these factors, you can select an appraiser who will provide an accurate, reliable valuation of your laboratory equipment for loan collateral purposes.

Regulatory Compliance in Laboratory Equipment Assessments

In the realm of lab equipment appraisals, regulatory compliance is crucial for ensuring credible, reliable assessments that align with industry standards. Understanding these regulations is essential for appraisers, lenders, and laboratory managers involved in equipment valuation for loan collateral.

Key Regulatory Frameworks

Uniform Standards of Professional Appraisal Practice (USPAP)

- Establishes foundational guidelines for credible appraisals

- Mandates ethical considerations and professional integrity

- Ensures thorough due diligence in the valuation process

- Provides confidence for lending institutions

International Organization for Standardization (ISO)

- Provides universal standards for lab equipment evaluation

- Ensures consistent best practices in equipment assessment

- Creates globally recognized valuation methodologies

- Supports universally acceptable appraisal practices

Federal and State Regulations

- Applies additional oversight for specialized equipment

- Involves regulatory agencies like FDA and EPA

- Requires in-depth knowledge of industry-specific guidelines

- Ensures comprehensive compliance for sensitive equipment

Consequences of Non-Compliance

Failing to adhere to established regulations can result in serious consequences, including:

- Potential withdrawal of funding

- Legal complications

- Reputation damage

- Compromised financial decision-making

Strategic Importance of Compliance

Regulatory compliance in laboratory equipment appraisals serves multiple critical purposes:

- Protects financial interests of lenders

- Mitigates risks for laboratory operators

- Ensures accurate and defensible equipment valuations

- Maintains industry credibility and professional standards

By integrating comprehensive compliance requirements into the appraisal process, stakeholders can confidently navigate complex valuation challenges while maintaining the highest professional and legal standards.

Overcoming Challenges in Equipment Valuation

Key Challenges in Laboratory Equipment Valuation

Equipment valuation for lab equipment used as loan collateral presents complex challenges that require specialized expertise and strategic approaches. Understanding these obstacles is crucial for accurate and reliable assessments.

Complex Equipment Diversity

- Wide range of laboratory equipment with varying specifications

- Equipment spans from advanced analytical instruments to basic laboratory supplies

- Significant variations in:

- Equipment age

- Functional condition

- Technological complexity

Market Data Limitations

Specialized laboratory equipment often presents unique valuation challenges due to:

- Limited transaction histories

- Restricted market comparables

- Niche technological specifications

Alternative Valuation Methodologies

To address market data constraints, appraisers can leverage multiple valuation approaches:

- Income approach: Assessing potential revenue generation

- Cost approach: Evaluating replacement and depreciation costs

- Comparative market analysis when possible

Regulatory Compliance Considerations

Laboratory equipment valuation requires rigorous attention to:

- Industry-specific safety standards

- Regulatory body requirements

- Comprehensive documentation of equipment specifications

- Verification of operational compliance

Communication and Transparency

Successful equipment valuation demands:

- Clear communication between all stakeholders

- Detailed reporting of valuation methodologies

- Transparent explanation of assessment criteria

- Alignment of expectations between borrowers and lenders

Strategic Approach to Overcoming Challenges

Effective lab equipment valuation requires a multifaceted strategy that combines technical expertise, comprehensive market knowledge, and robust communication protocols. By addressing these key challenges systematically, appraisers can provide accurate and reliable equipment valuations for loan collateral purposes.

How Professional Appraisals Strengthen Your Loan Application

When applying for a loan, especially for business-related purposes, demonstrating the value of your assets can make a significant difference in securing the necessary funding. A professional appraisal of lab equipment not only provides an accurate valuation but also strengthens your overall loan application in several key ways.

Key Benefits of Professional Lab Equipment Appraisals

Objective Market Value Assessment

Professional appraisals offer a critical advantage by providing an objective assessment of your lab equipment's market value. Lenders require this information to accurately determine the loan's risk profile. A qualified appraiser carefully evaluates several crucial factors:

- Equipment condition

- Age of equipment

- Current functionality

- Technological relevance

Enhanced Negotiation Credibility

A well-documented appraisal serves multiple strategic purposes in loan negotiations:

- Establishes a solid foundation for financial discussions

- Demonstrates proactive asset management

- Shows serious commitment to financial responsibilities

- Potentially leads to more favorable loan terms

Specialized Equipment Valuation

Specialized lab equipment presents unique valuation challenges due to its complex nature. An experienced appraiser brings critical industry insights that ensure comprehensive evaluation, including:

- Precise technological assessments

- Understanding of brand-specific value

- Consideration of current market trends

- Accurate depreciation calculations

Streamlined Loan Approval Process

Professional appraisals significantly simplify the loan approval process by providing comprehensive documentation that:

- Reduces potential delays

- Provides clear, verifiable equipment value

- Increases lender confidence

- Expedites overall application review

Investing in a professional lab equipment appraisal is a strategic decision that enhances your loan application's credibility and supports a favorable financial outcome.

Real-World Success: Lab Equipment Appraisal Case Studies

Laboratories across various sectors depend on specialized equipment to drive operational efficiency. Accurate valuation of these assets is critical, especially when leveraging them as loan collateral. The following case studies demonstrate the strategic importance of comprehensive lab equipment appraisals.

Pharmaceutical Research Funding

- Comprehensive appraisal conducted on high-throughput screening instruments

- Assessment revealed precise market value and technological productivity enhancement

- Enabled substantial funding secured for research and development

- Provided lenders clear visibility into asset value and potential

University Research Partnership Valuation

- Accredited appraiser evaluated advanced analytical instruments

- Detailed analysis outlined potential return on investment

- Facilitated confident negotiations with venture capitalists

- Resulted in significant increase in financial research support

Biotech Startup Debt Refinancing

- Equipment appraisal focused on gene sequencing technology

- Provided comprehensive report on current market value

- Projected technology demand over subsequent years

- Secured more favorable lending terms through precise valuation

These case studies underscore the pivotal role of professional equipment appraisals in strategic financial planning. Precise valuations empower organizations to maximize their asset potential, access capital more effectively, and demonstrate the tangible value of their scientific investments.

Emerging Trends in Laboratory Equipment Valuation

Key Trends Shaping Laboratory Equipment Valuation

As laboratories continue to evolve, the landscape of equipment valuation has become increasingly complex and nuanced. Understanding these emerging trends is critical for stakeholders seeking accurate assessments of lab assets.

Technological Integration and Advanced Equipment

- Sophisticated equipment like automated analyzers and advanced imaging systems are becoming standard in modern laboratories

- Valuation now requires deep understanding of:

- Technological capabilities

- Functional efficiency

- Current market demand

- Cutting-edge technology typically drives higher equipment value due to enhanced performance characteristics

Sustainability and Environmental Considerations

- Laboratories are increasingly prioritizing eco-friendly and energy-efficient equipment

- Sustainability factors now directly impact equipment valuation

- Key considerations include:

- Waste reduction potential

- Energy conservation capabilities

- Environmental compliance

- Equipment with strong sustainability profiles often commands premium values in secondary markets

Global Marketplace Dynamics

- International sourcing of laboratory equipment introduces complex valuation challenges

- Critical factors influencing valuation include:

- Currency exchange rate fluctuations

- Regional market demands

- Geographic availability of specific technologies

- Comprehensive market insights are essential for accurate equipment assessment

Rising Market for Refurbished Equipment

- Growing trend of purchasing pre-owned laboratory equipment

- Budget optimization drives increased interest in used assets

- Crucial valuation considerations:

- Equipment condition

- Age and depreciation

- Previous usage history

- Potential for recertification

Successful laboratory equipment valuation now requires a multifaceted approach that integrates technological, environmental, economic, and market-specific insights. Professionals must continuously adapt their methodologies to capture the true value of modern laboratory assets.

View all Locations

BEST-IN-CLASS APPRAISERS, CREDENTIALED BY:

.svg)